Claim Tax Collected at Source

When you make high-value purchases—like buying a car or booking an international trip—you might notice an additional charge on your bill labeled Tax Collected at Source (TCS). This amount is collected by the seller and deposited with the Income Tax Department under your PAN. It’s a way to ensure that individuals making significant purchases are reporting their income and taxes accurately.

Steps to update Tax Collectedted at Source

There are three ways to add the TCS:

Import from ITD using Autofill

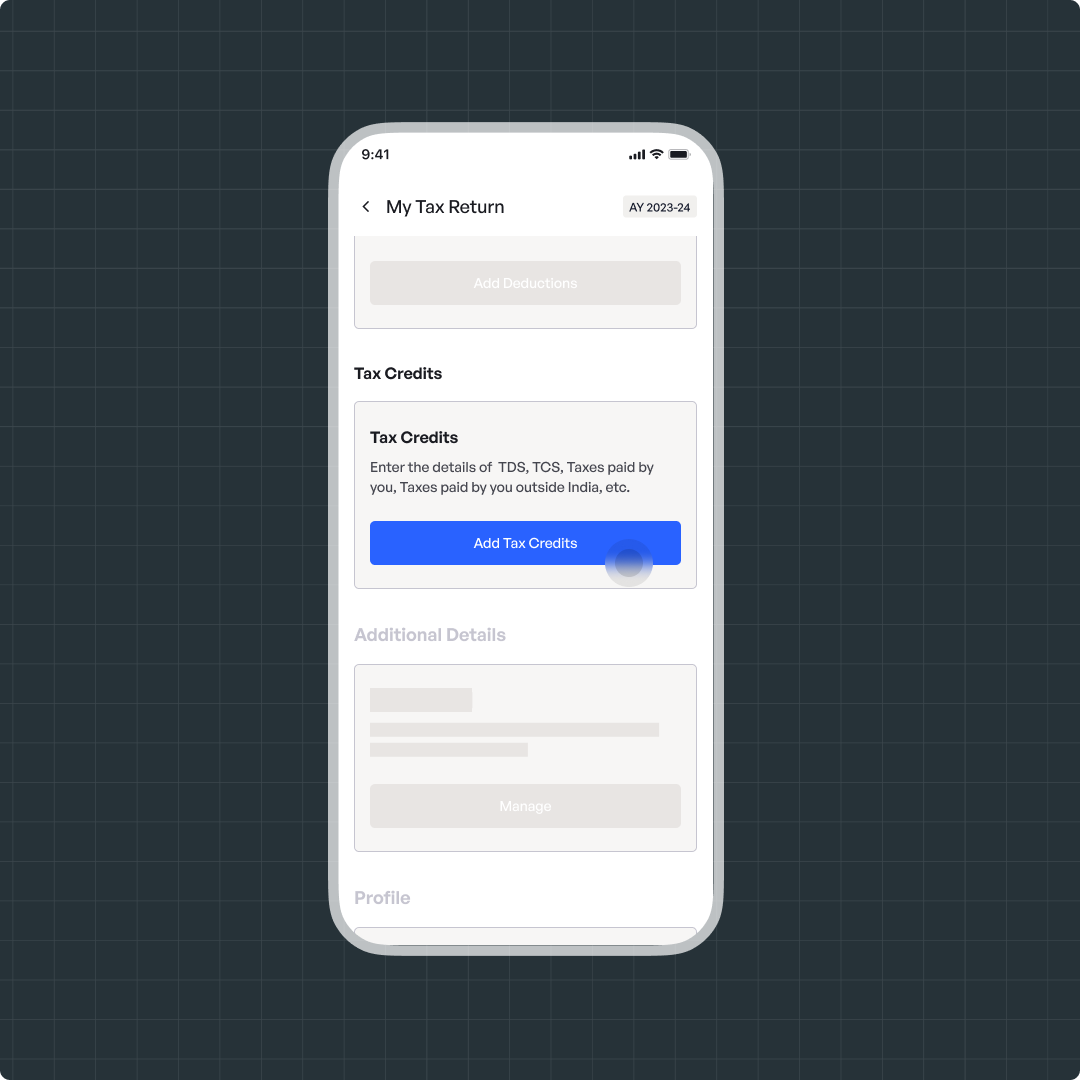

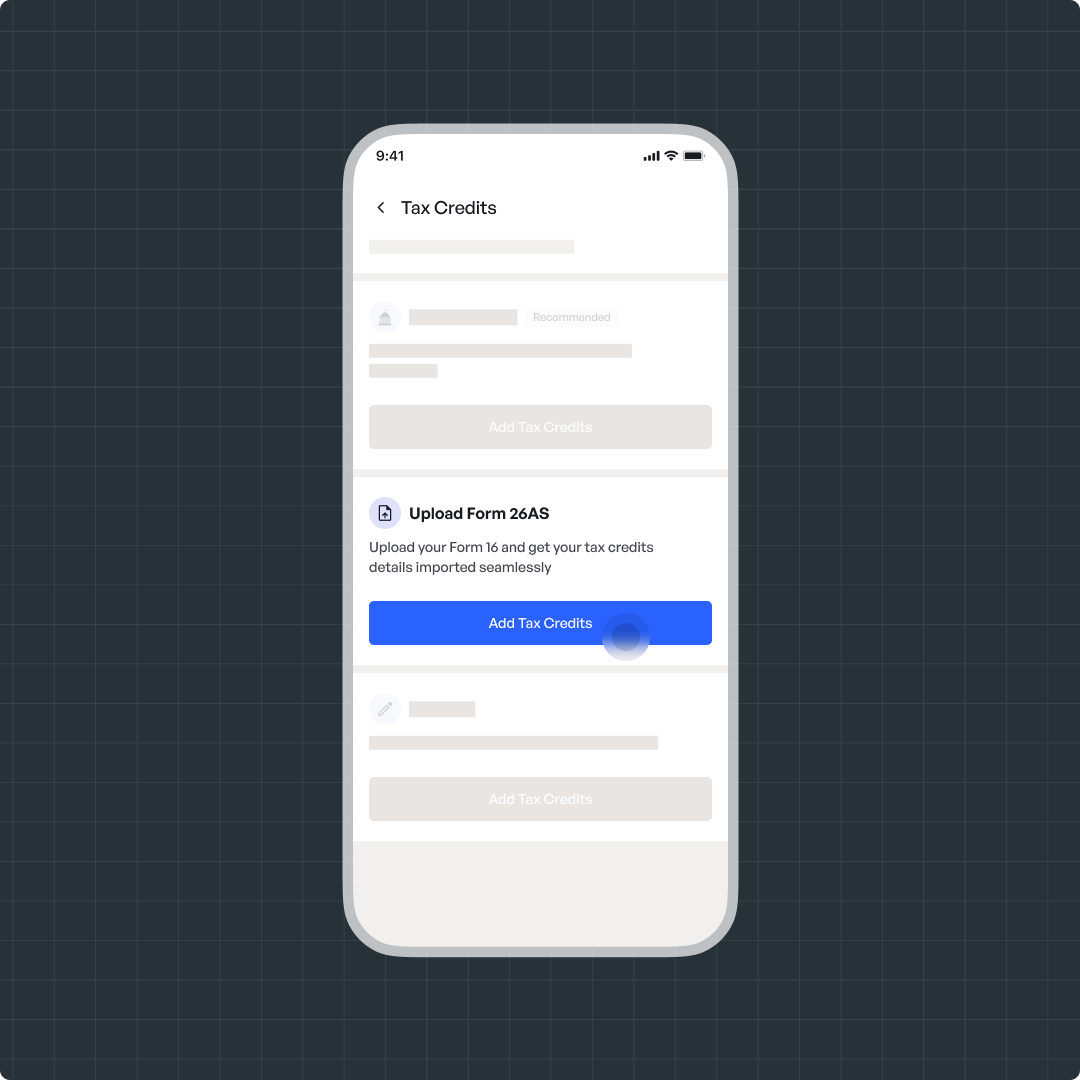

Navigate to File > Add Tax Credits

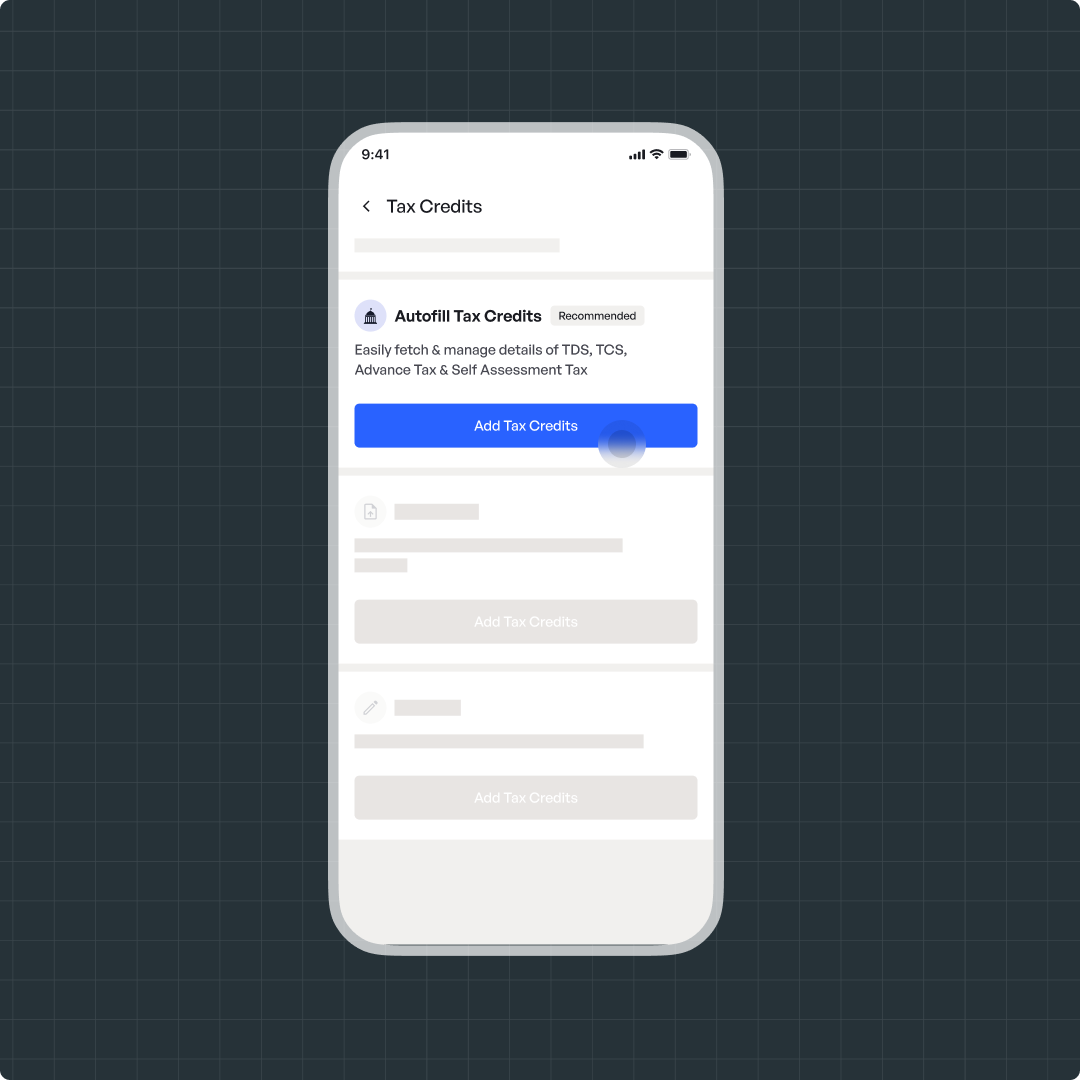

Click on Import from ITD using Autofill

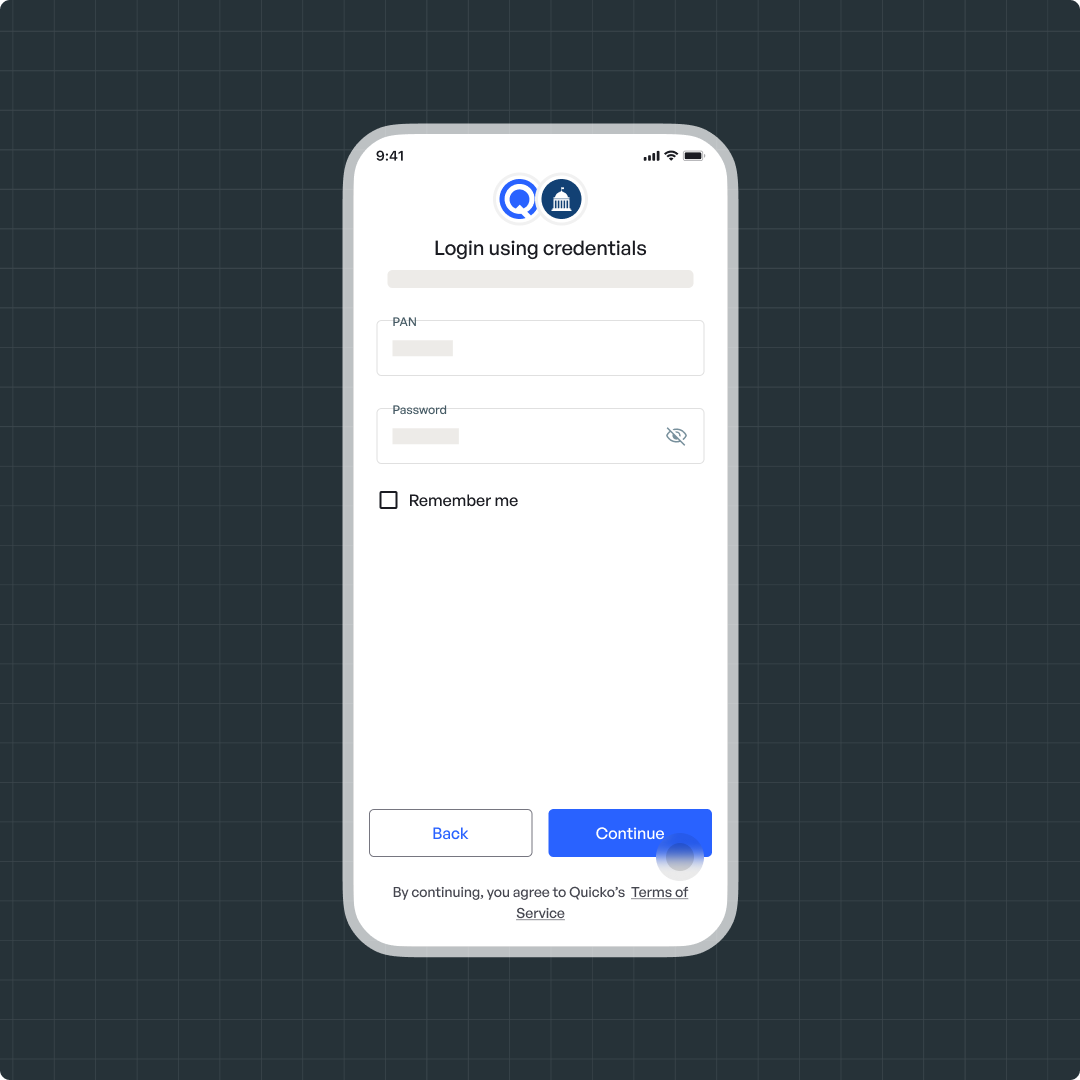

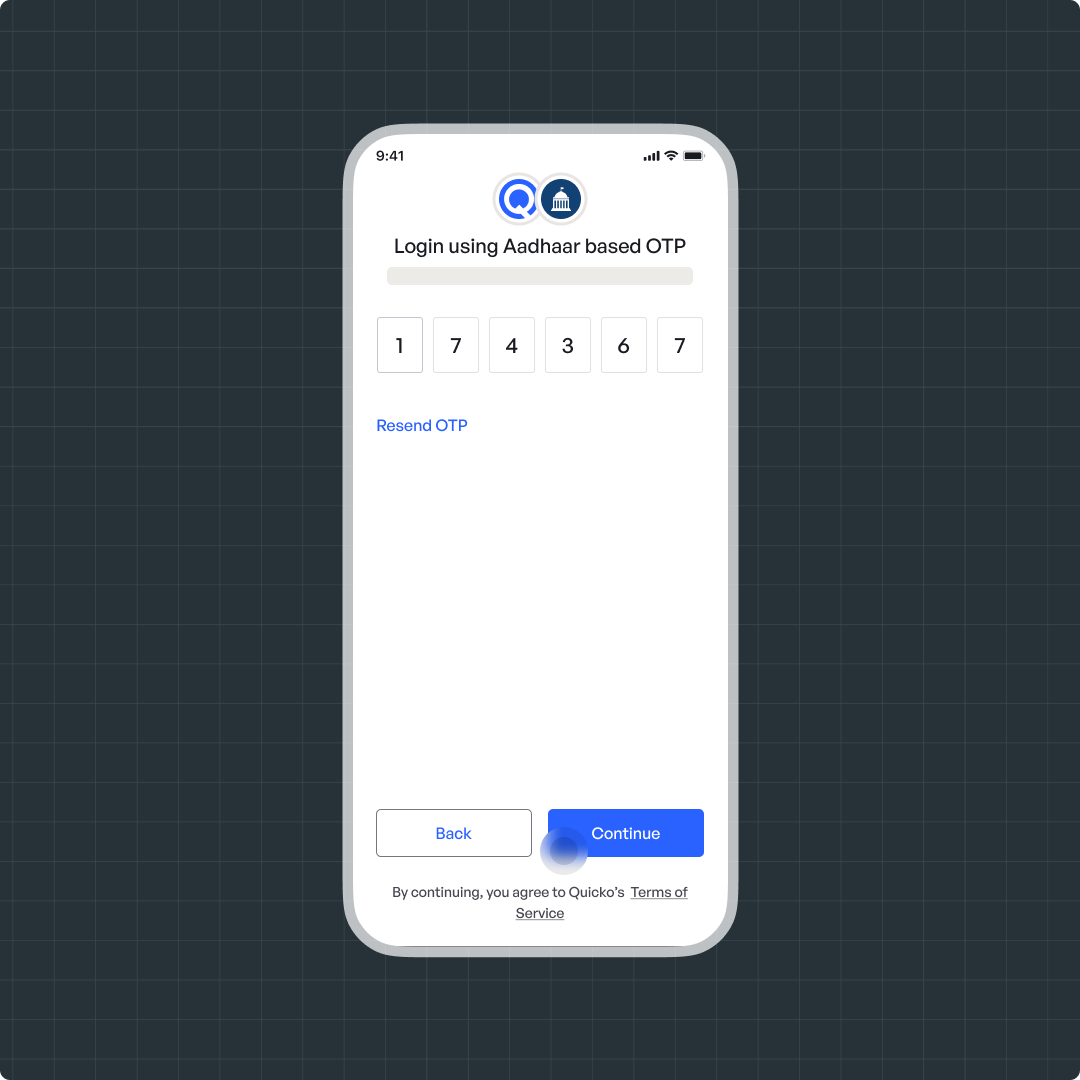

Connect to the Income Tax Department via Aadhaar OTP or login credentials.

Once connected, your TDS, TCS, Advance Tax, and Self-Assessment Tax will be automatically imported

Upload Form 26AS

Go to File > Add Tax Credits

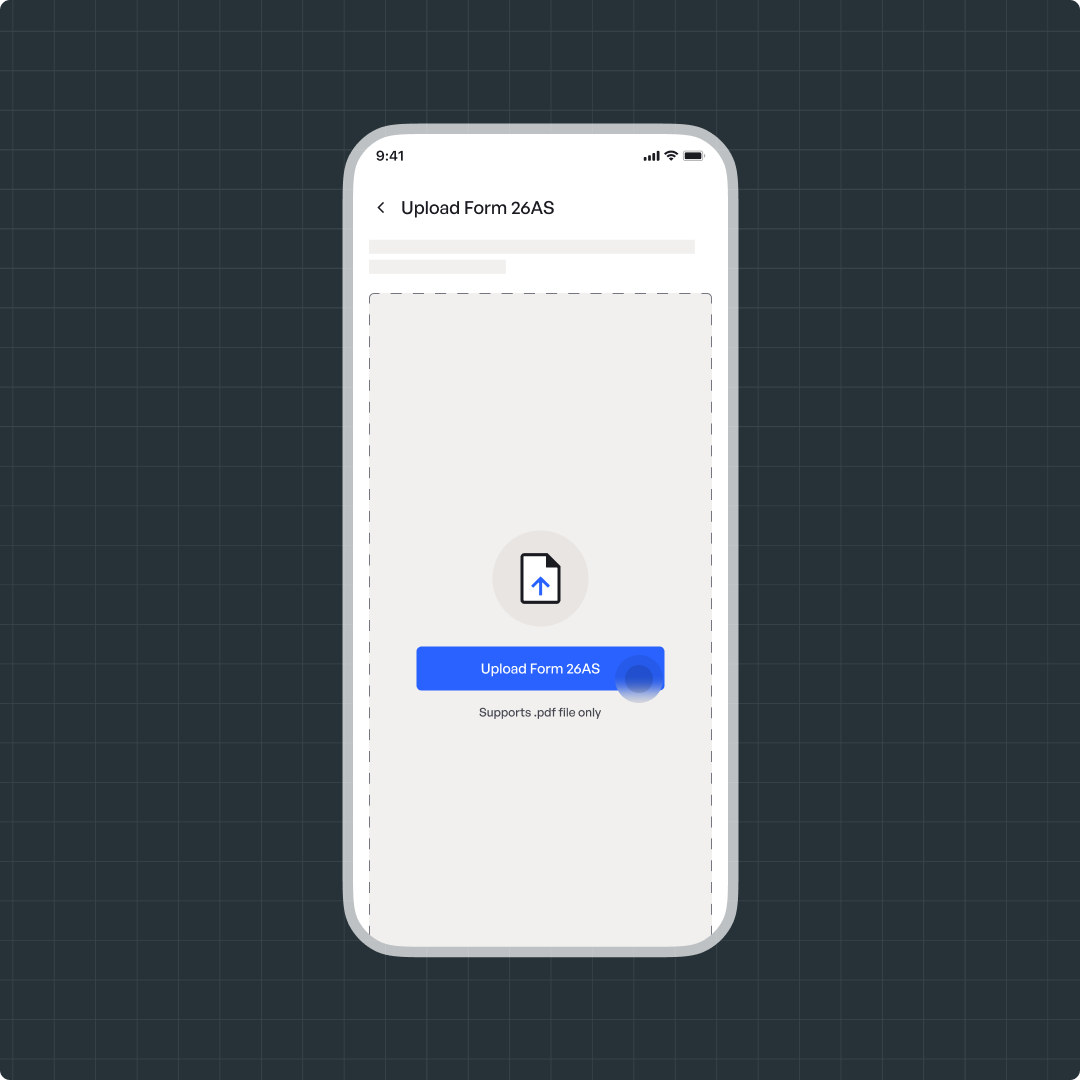

Click on Upload Form 26AS

Attach your Form 26AS (downloaded from the Income Tax Portal

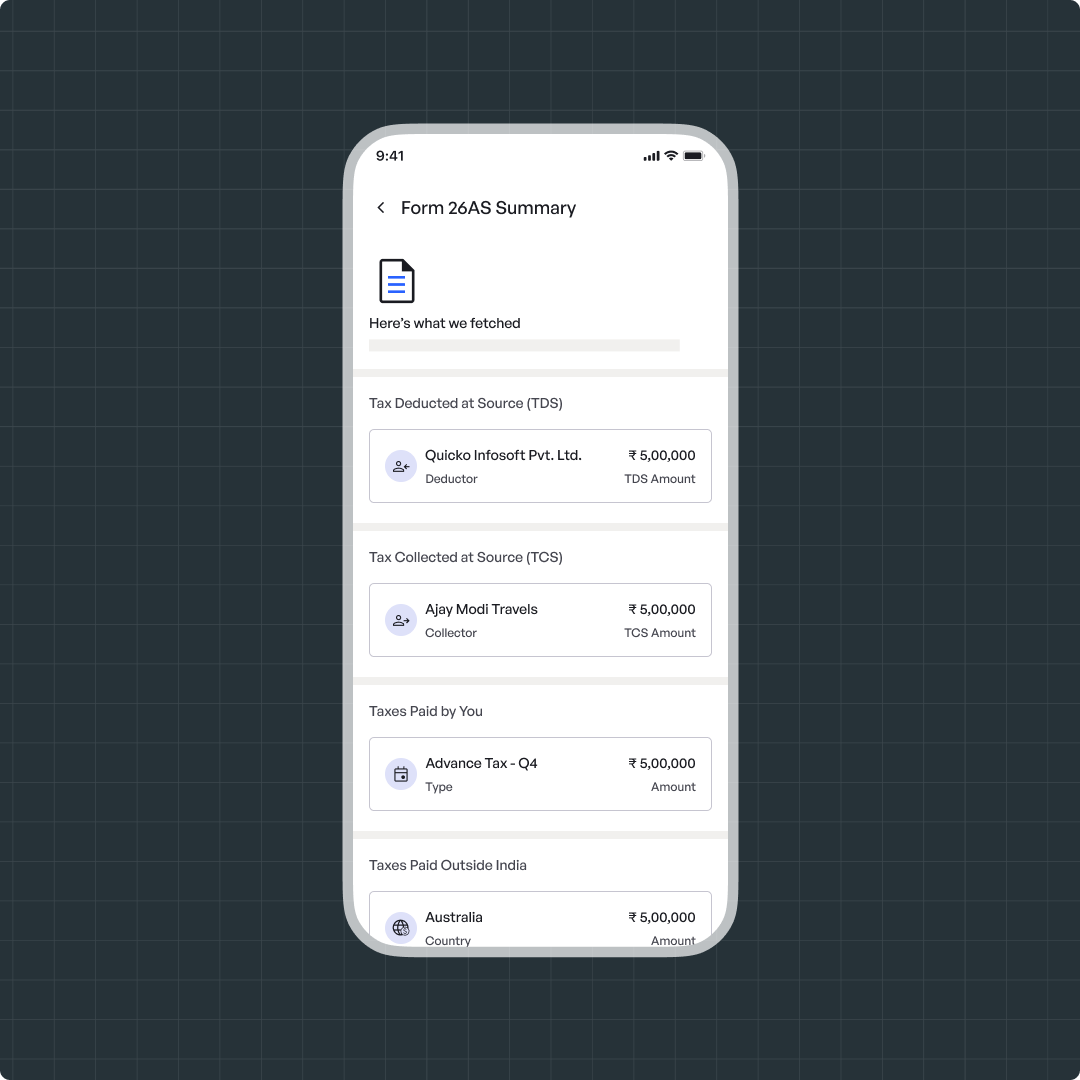

Review the auto-fetched credits and proceed

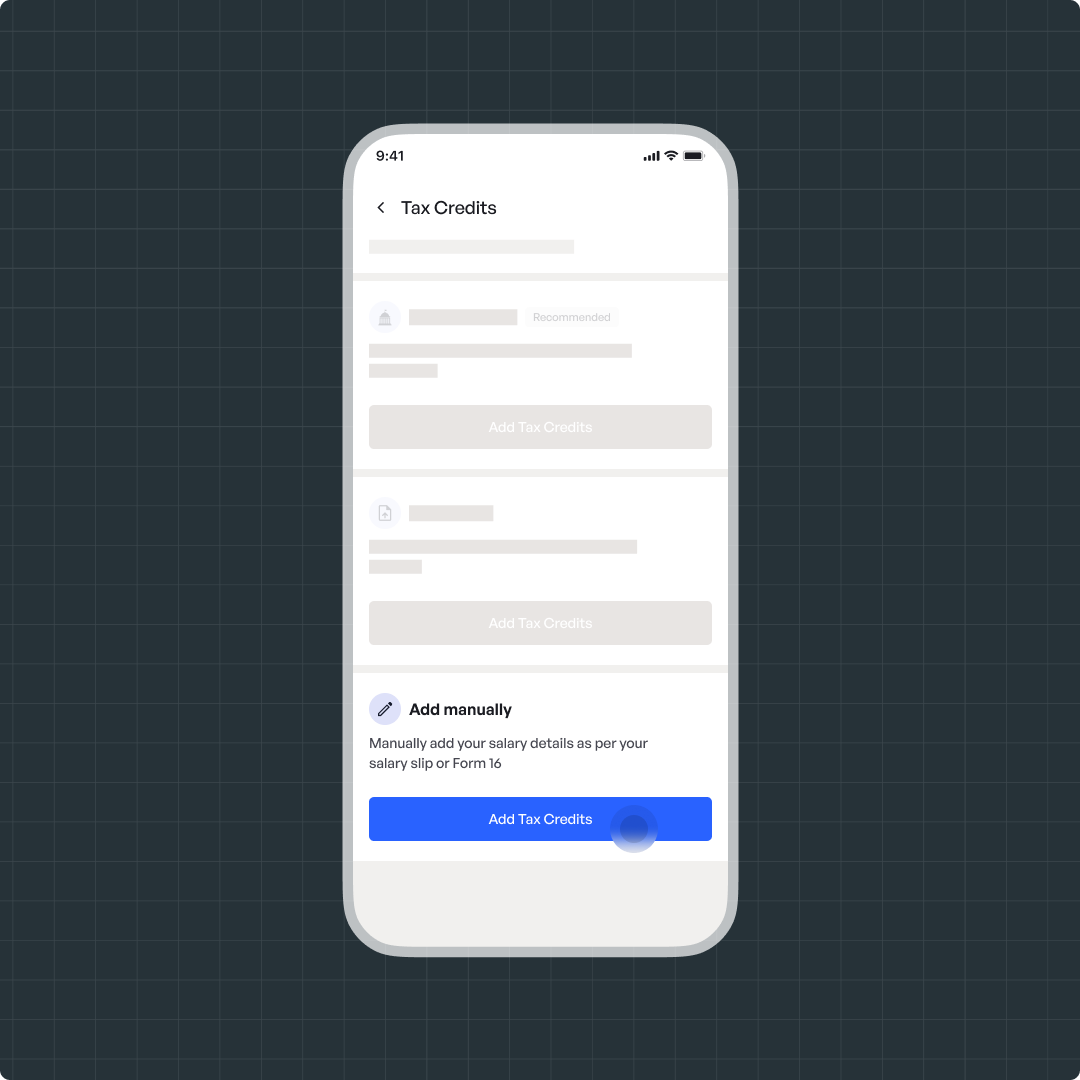

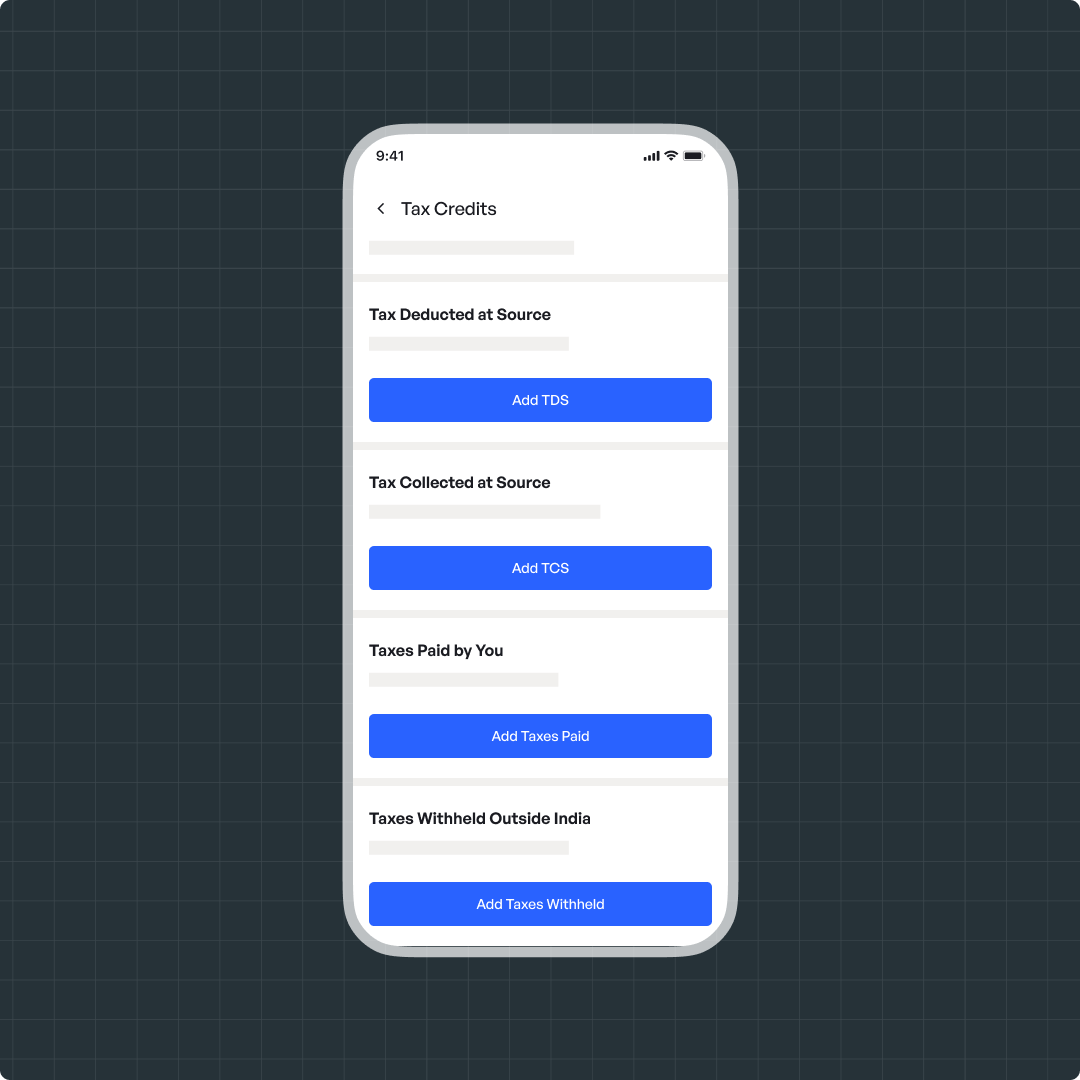

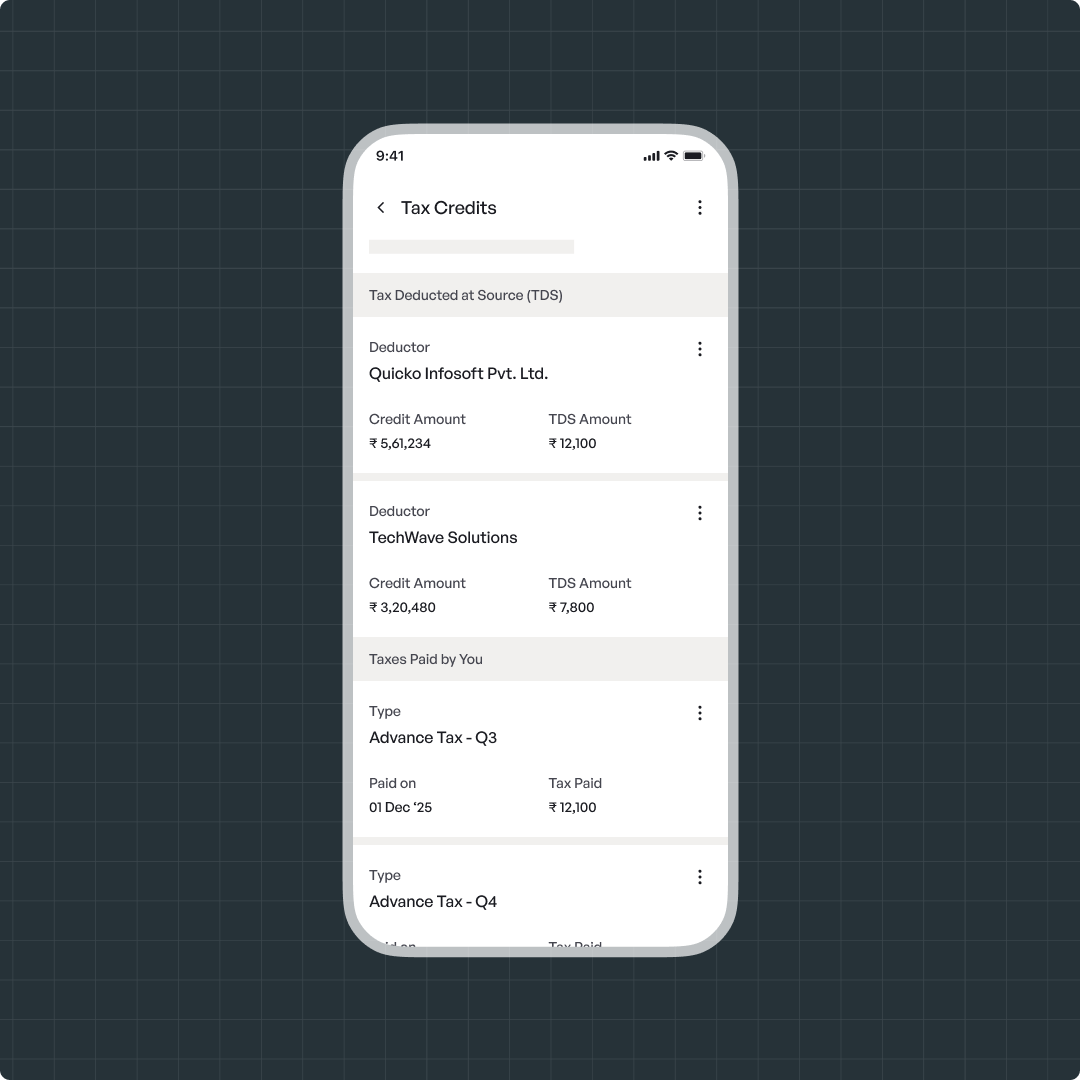

Add Manually

Navigate to File > Tax Credits

Click on Add Manually

Select the type of tax credit: TDS, TCS, Advance Tax, or Self-Assessment Tax

Fill in the required details such as TAN, Name of Deductor, Amount, etc.

Steps to update Tax Collectedted at Source

There are three ways to add the TCS:

Import from ITD using Autofill

- Navigate to File > Add Tax Credits

- Click on Import from ITD using Autofill

Connect to the Income Tax Department via Aadhaar OTP or login credentials.

Once connected, your TDS, TCS, Advance Tax, and Self-Assessment Tax will be automatically imported

- Navigate to File > Add Tax Credits

- Click on Import from ITD using Autofill

Connect to the Income Tax Department via Aadhaar OTP or login credentials.

Once connected, your TDS, TCS, Advance Tax, and Self-Assessment Tax will be automatically imported

Upload Form 26AS

Go to File > Add Tax Credits

- Click on Upload Form 26AS

- Attach your Form 26AS (downloaded from the Income Tax Portal

- Review the auto-fetched credits and proceed

Go to File > Add Tax Credits

- Click on Upload Form 26AS

- Attach your Form 26AS (downloaded from the Income Tax Portal

- Review the auto-fetched credits and proceed

Add Manually

Navigate to File > Tax Credits

Click on Add Manually

Select the type of tax credit: TDS, TCS, Advance Tax, or Self-Assessment Tax

Fill in the required details such as TAN, Name of Deductor, Amount, etc.

Navigate to File > Tax Credits

Click on Add Manually

Select the type of tax credit: TDS, TCS, Advance Tax, or Self-Assessment Tax

Fill in the required details such as TAN, Name of Deductor, Amount, etc.

Still Need Help?

Raise a ticket to get in touch with us.

Related Articles

Claim Tax Relief on Foreign Income

If you have earned income from foreign sources and taxes were withheld in the country where the income was generated, you may be eligible to claim a credit or deduction for those foreign taxes paid. Web Mobile Web Steps to Add Foreign Tax Credits Go ...Update Tax Deducted at Source

TDS (Tax Deducted at Source) is the tax that’s deducted by the payer from your income before you receive it. This could be from your salary, professional income, rent, etc. The payer then deposits this tax with the Income Tax Department on your ...Claim brought forward TDS

If excess TDS (Tax Deducted at Source) has been deducted in a previous financial year and not fully claimed, you can carry it forward and adjust it in the current year—provided the related income is also reported in your return. This helps ensure you ...Autofill Tax Credits from Income Tax Department

If you've paid Advance Tax, had TDS (Tax Deducted at Source) deducted, purchased a car (which involves TCS - Tax Collected at Source), or made a Self-Assessment Tax payment while filing your ITR — all of these can be claimed under Tax Credits. ...Claim Expenses for Other Incomes

You can claim certain expenses against Other Incomes in your tax return, including: Interest on loans: If you've taken a loan to earn income from investments like bonds or fixed deposits, the interest paid on that loan can be deducted. Commission or ...