Add Salary Income

For most taxpayers in India, salary is the primary source of income. It comprises various components such as basic pay, allowances, bonuses, and more—all of which need to be accurately reported while filing your tax return.

Autofill from ITD

Upload Form 16

Autofill from ITD

Upload Form 16

Understanding these components is crucial not just for effective financial planning, but also for accurate tax filing.

Keep reading to explore the different methods of adding your salary income with ease.

Note: If your Form 16 is password-protected, you'll be prompted to enter the password during upload.

The password is usually your PAN in uppercase letters (e.g., ABCDE1234F).Web

Mobile

Web

Autofill from ITD

- Navigate to File > Incomes > Salary

- Choose Autofill your salary from ITD and click on Proceed

- Connect to the ITD app using your credentials or Aadhaar OTP

- Details like employer name, address, salary breakdown, and TDS will be imported.

Upload Form 16

- Navigate to File > Incomes > Salary

- Choose Upload Form 16 and click on Proceed

- Upload your Form 16 Part A and B

- You can then verify the fetched details and continue

Add Manually

- Navigate to File > Incomes > Salary

- Choose Add Manually and click on Proceed

- Add the employer's name, address, and category

- Enter the salary breakdown and TDS details (if TDS is deducted)

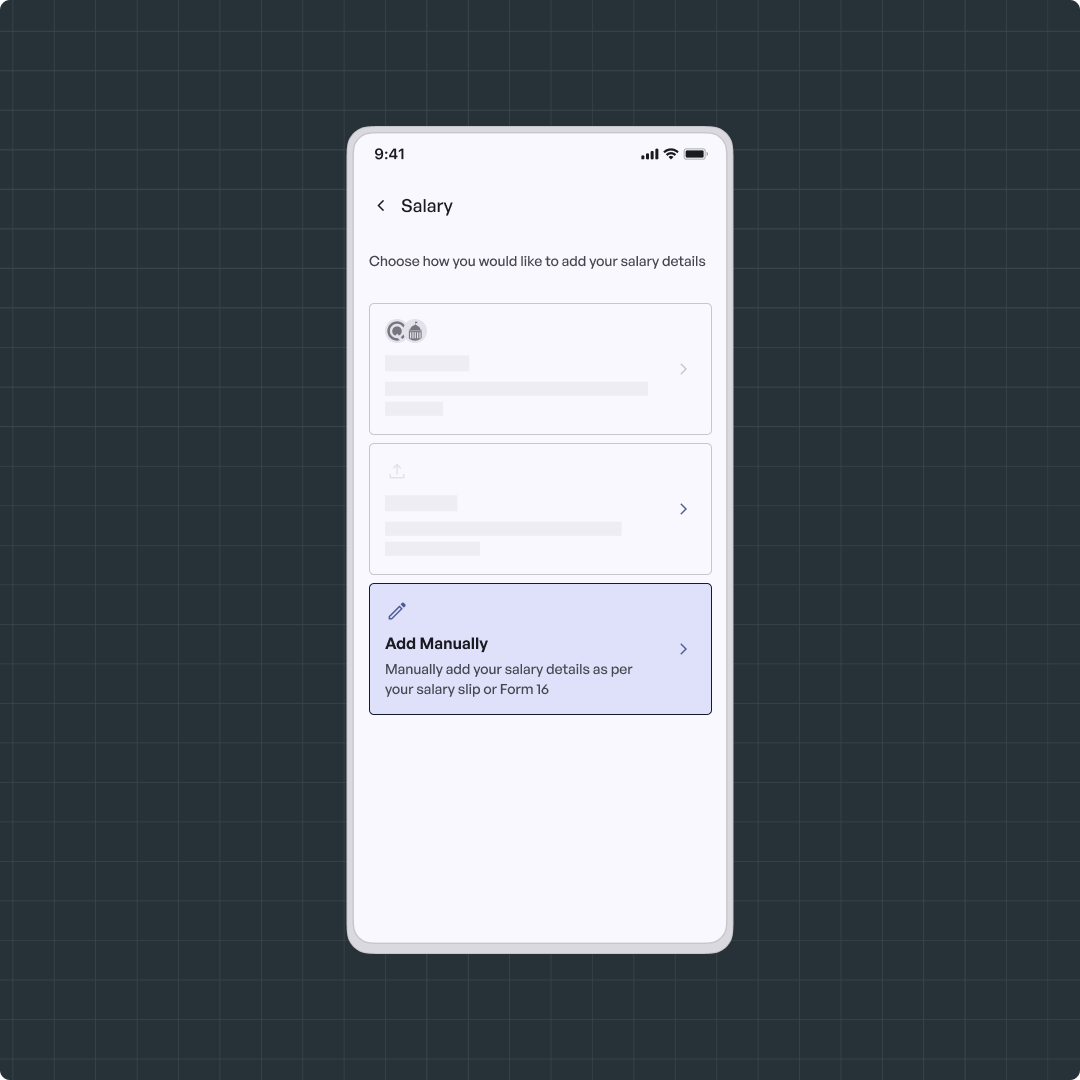

Mobile

Autofill from ITD

- Navigate to File > Incomes > Salary

- Choose Autofill your salary from ITD and click on Proceed

- Connect to the ITD app using your credentials or Aadhaar OTP

- Details like employer name, address, salary breakdown, and TDS will be imported.

Upload Form 16

- Navigate to File > Incomes > Salary

- Choose Upload Form 16 and click on Proceed

- Upload your Form 16 Part A and B

- You can then verify the fetched details and continue

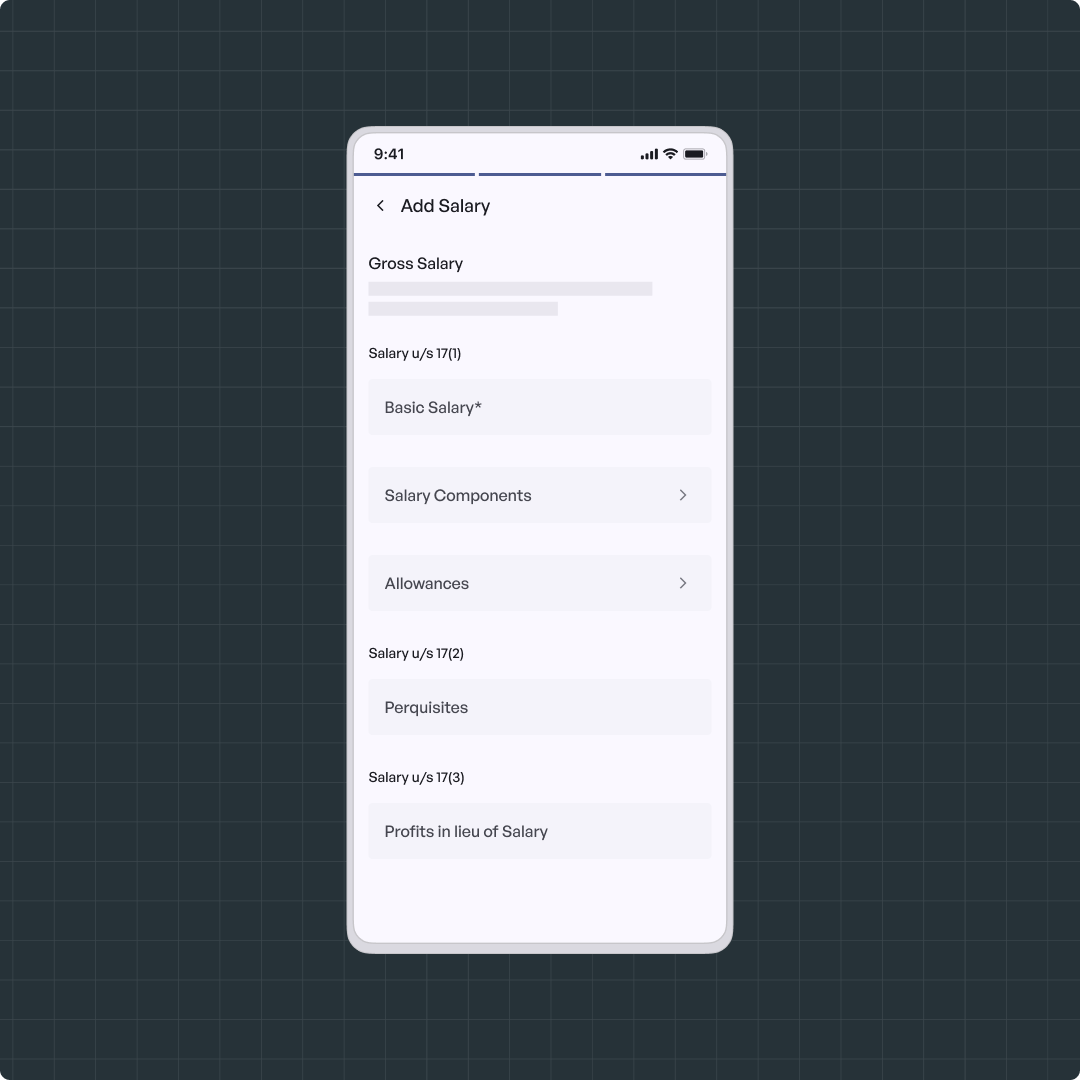

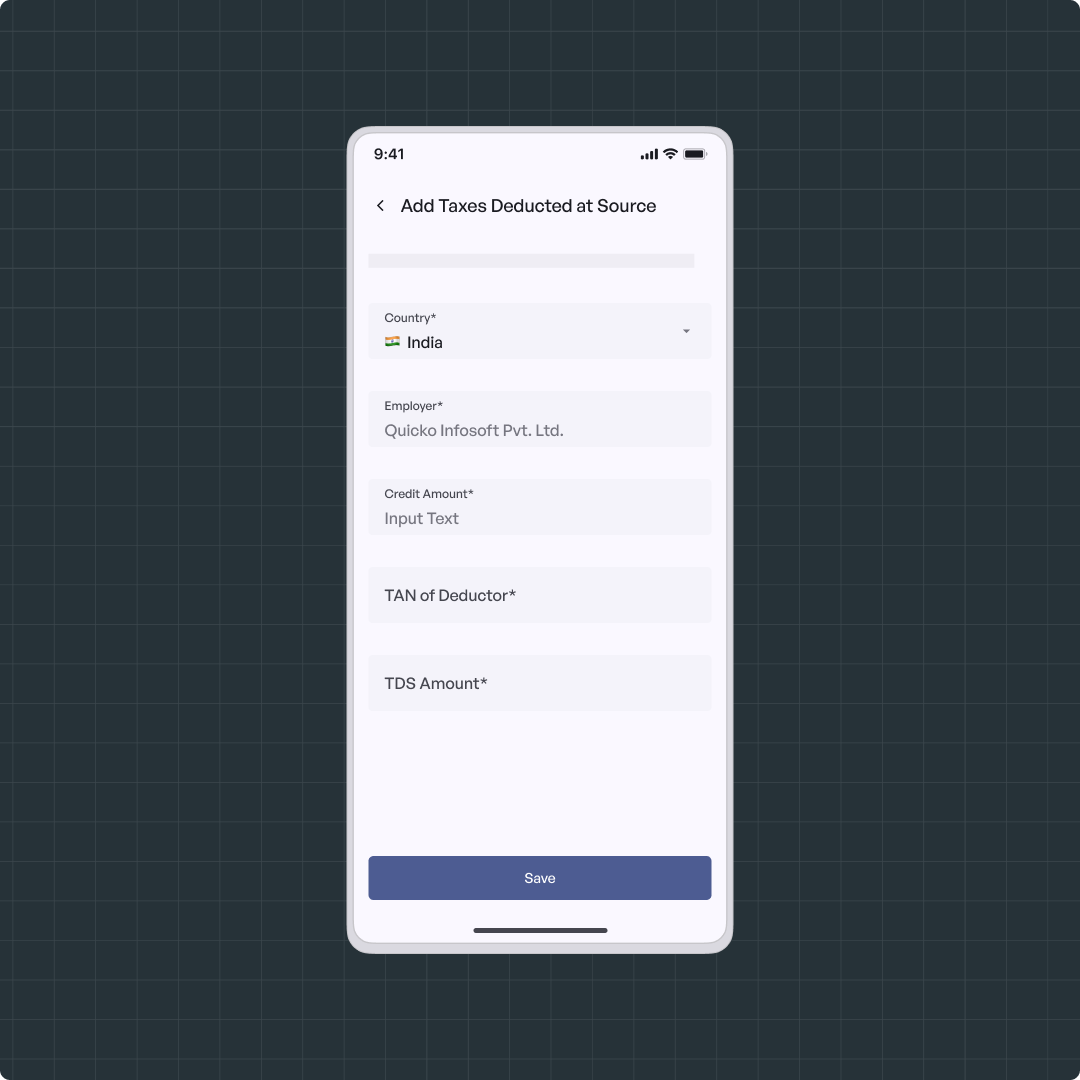

Add Manually

- Navigate to File > Incomes > Salary

- Choose Add Manually and click on Proceed

- Add the employer's name, address, and category

- Enter the salary breakdown and TDS details (if TDS is deducted)

Need Help?

Raise a ticket to get in touch with us

Related Articles

Add Salary Income without Form 16

Web Mobile Web Steps to add salary income using pay slips: Navigate to File > Incomes > Salary Choose the Add Manually option and proceed Add your employer’s name, category, and address Enter your salary breakdown, including gross salary, allowances, ...Add Salary using Form 16

Form 16 is issued by employers to their employees and serves as a summary of the salary paid and Tax Deducted at Source (TDS) during the financial year. It is a crucial document for filing your income tax return. Form 16 is divided into two parts: ...Autofill your Income Tax Return

Don’t worry if you haven’t started your Income Tax Return yet—autofill makes it easy! Just fetch your details directly from the Income Tax Department (ITD). Web Mobile Web To Get Started: Click on Start Here Select Import from ITD using Autofill ...How to add foreign incomes?

If you have earned any kind of income from foreign countries, you have to report such incomes when filing your ITR in India. While adding these incomes, the process remains the same as adding regular incomes in each category. The only difference is ...Add Tax Credits using Form 26AS

Form 26AS is your annual tax statement that shows all the taxes deposited against your PAN. This includes TDS (Tax Deducted at Source) on your salary or interest income, and TCS (Tax Collected at Source) on high-value transactions. You can download ...