Manage Billing Details

Need to change your plan, view your billing history, or update billing information? Here’s a detailed guide to help you manage everything related to billing efficiently.

Switch Your Plan

You can switch to a different plan at any time. When upgrading, any unused balance from your current plan will be applied to the new one based on the remaining days. You’ll only need to pay the difference. The new plan will take effect immediately, with billing based on the purchase date.

Web

Mobile

Web

Steps to switch a plan

- Navigate to Upgrade Plan

- Click on Change Plan

- Choose your Preferred Plan and Billing Period

- Update the Billing Details for a GST invoice (if needed)

- Click on Upgrade and proceed to pay

View your billing history

Use the steps below to view and download your billing statements.

- Navigate to Profile Icon > View Profile

- Go to Billing from the side nav bar and click on Billings history

- You can view the billing history and download the invoice from here.

Update billing details

You can update the name and place of supply on future invoices by editing your billing details. You can also include your GSTIN, legal name, and business address if applicable.

- Navigate to Profile Icon > My Account

- Scroll down and update the Billing Details

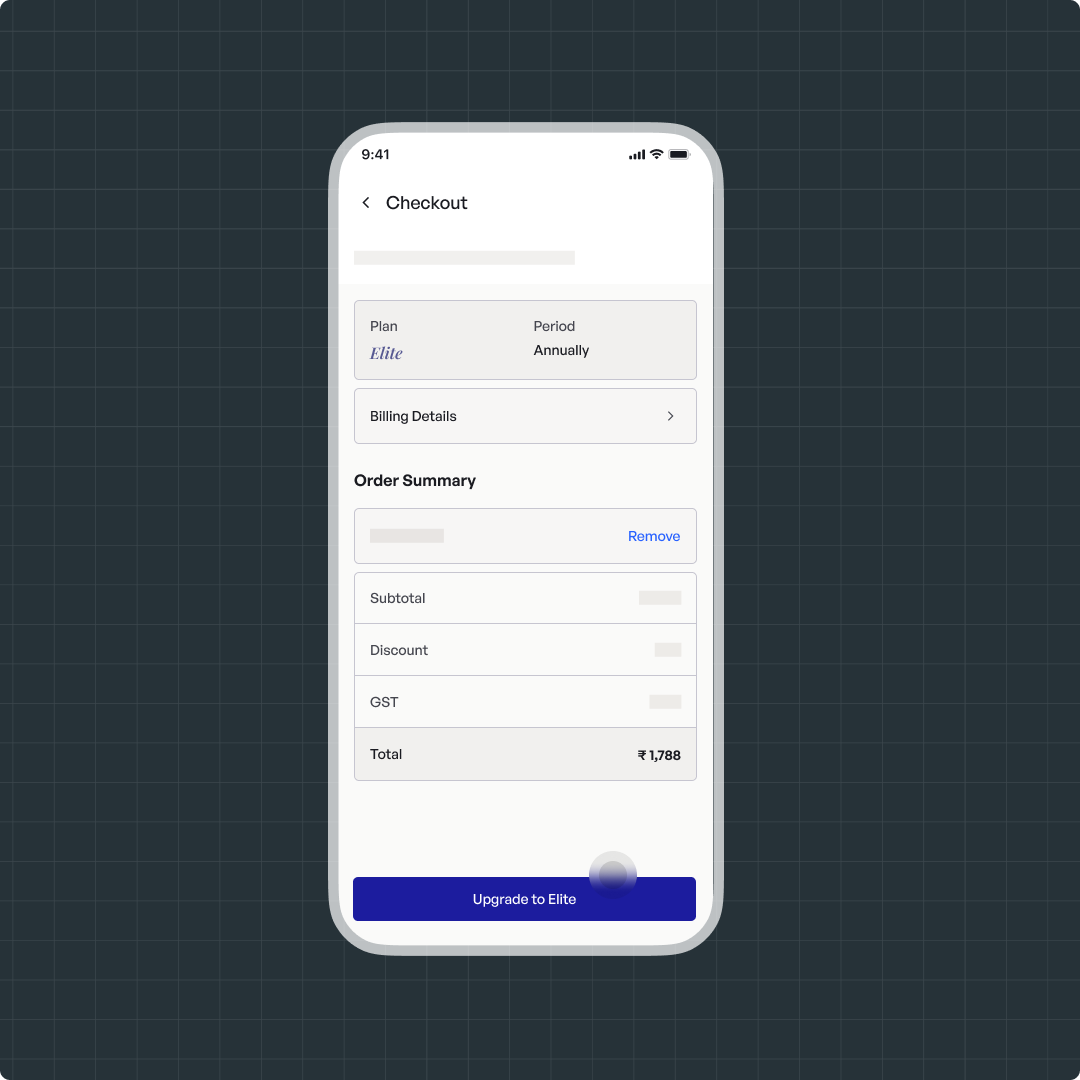

Mobile

Steps to switch a plan

- Navigate to Upgrade Plan

- Click on Change Plan

- Choose your Preferred Plan and Billing Period

- Update the Billing Details for a GST invoice (if needed)

- Click on Upgrade and proceed to pay

View your billing history

Use the steps below to view and download your billing statements.

- Navigate to Profile Icon > View Profile

- Go to Billing from the side nav bar and click on Billings history

- You can view the billing history and download the invoice from here.

Update billing details

You can update the name and place of supply on future invoices by editing your billing details. You can also include your GSTIN, legal name, and business address if applicable.

- Navigate to Profile Icon > My Account

- Scroll down and update the Billing Details

Need Assistance?

If you still have any further queries, you can raise a ticket to get in touch with us.

Related Articles

Change PAN details

Your Permanent Account Number (PAN) is a unique identifier issued by the Income Tax Department (ITD). If you’ve mistakenly entered the wrong PAN or used a family member’s PAN, here’s how you can fix it. Web Mobile Web Added a Family Member’s PAN? If ...Manage Connected Apps

You can view and manage all the apps you have connected across different modules on Quicko. Keep reading to find out how. How to view connected apps: 1. Click on the Profile Icon > View Profile. 2. Click on ‘Connected Accounts’. 3. To add a new app ...Update Profile Details

Keeping your personal details up to date is important, as your residential status and age can impact your tax rates and eligible deductions. As per ITD, ensuring that your profile details match their records is crucial for seamless tax return filing. ...Update Aadhaar Details

Aadhaar is a key identification document required for various purposes, including opening a bank account, a demat account, and filing your tax return. Keeping your Aadhaar details updated ensures a smooth verification process. Important Note: Before ...Manage Bank Accounts

Keeping your bank account details updated is essential for savings, payments, and investments. Whether you're adding a new account, updating an existing one, or closing a dormant account, ensure that your records are accurate. Important Note: All ...