Rental Income from Sub-Letting

Rental income earned from properties you own is taxed as income from house property. However, if you sub-let a property that you don’t own, the income isn’t considered house property income. It depends on how the property was sub-letted. If it was for business purposes, it would be taxed as income from business or profession. Otherwise, it will fall under income from other sources.

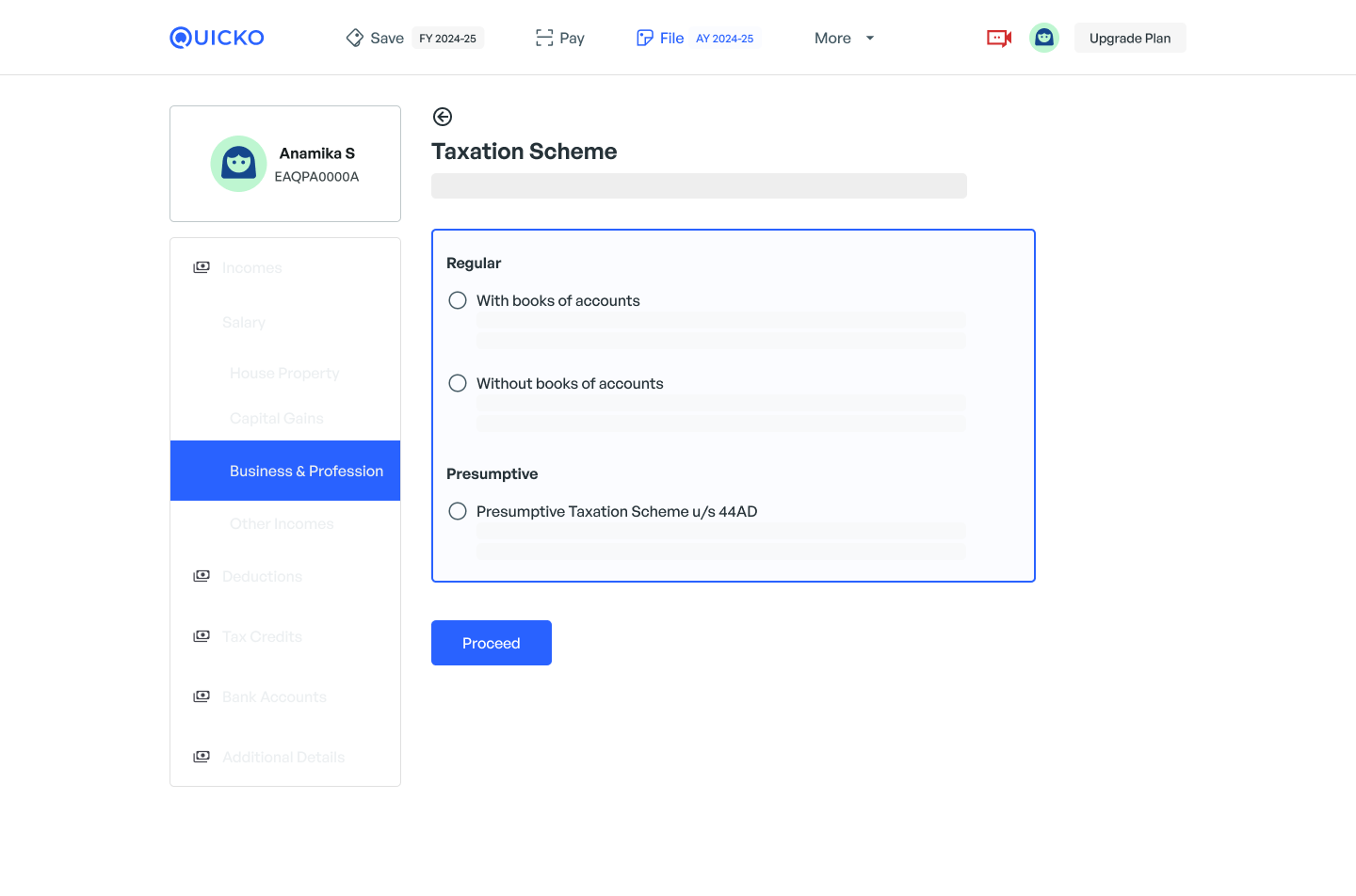

Web

Mobile

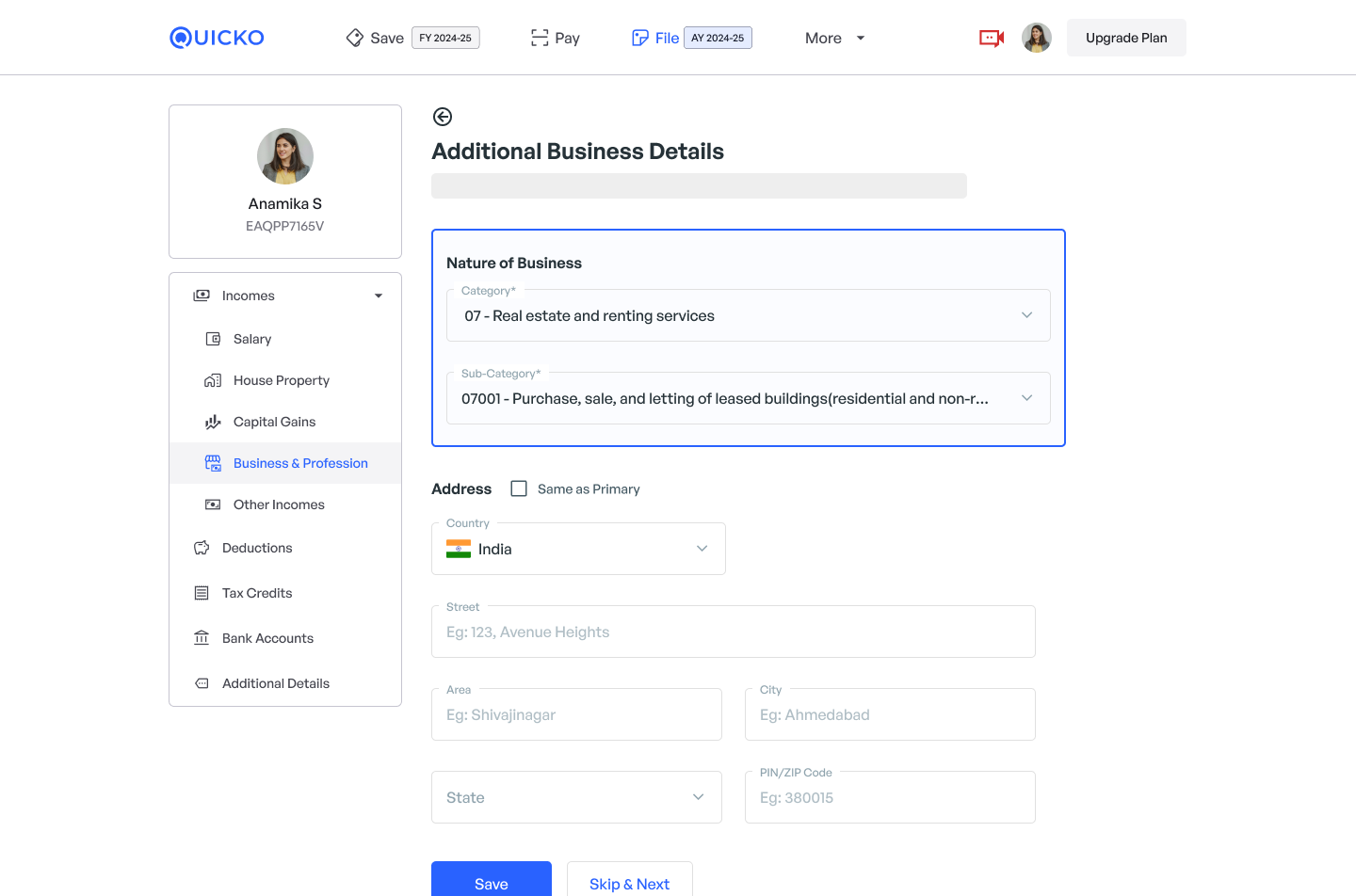

Web

How to Add Sub-Let Income as Other Sources

- Navigate to File > Incomes > Other Incomes and click on Any Other income

- Add the income under Others

How to Add Sub-Let Income as Business & Profession:

- Navigate to File > Incomes > Business & Profession

- Select Services as the nature of business

3. Choose the appropriate taxation scheme and provide Business Details

4. Select Real estate and renting services as the business category, and add the property address

5. Enter the revenue and expenses for your sub-letting business.

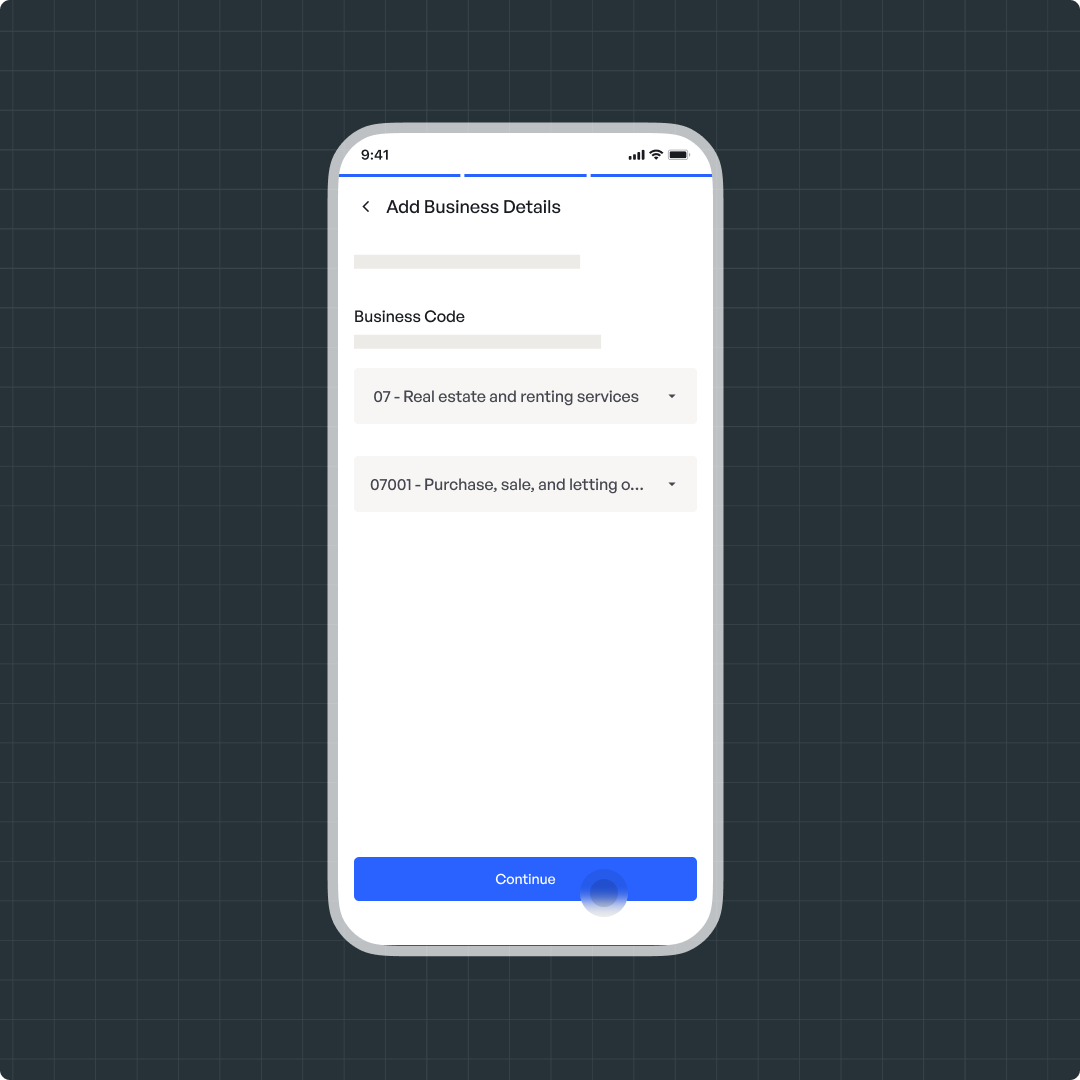

Mobile

How to Add Sub-Let Income as Other Sources

- Navigate to File > Incomes > Other Incomes and click on Any Other income

2. Add the income under Others

How to Add Sub-Let Income as Business & Profession:

1. Navigate to File > Incomes > Business & Profession

2. Select Services as the nature of business

3. Choose the appropriate taxation scheme and provide Business Details

4. Select Real estate and renting services as the business category, and add the property address

5. Enter the revenue and expenses for your sub-letting business.

Need Help?

Raise a ticket to get in touch with us

Related Articles

Add Rental Income for a Jointly Owned Property

Jointly-owned property is held by two or more people—whether spouses, business partners, friends, or family members. It’s a smart tax move since rental income, property taxes, home loan interest, and principal repayment are shared among co-owners. ...Manage House Property Income

House property includes any building or land, such as a house, apartment, office space, or hotel. This guide explains when to report your property in the ITR, how to add it, and the required details. When to Report House Property in Your ITR You earn ...How to Declare Capital Gains as Business Income

If you trade stocks frequently whether delivery-based or intraday in large volumes, and it’s your main source of income, you can choose to report these gains as business income in your Income Tax Return (ITR). Web Mobile Web Steps to Report Capital ...Add Dividend Income

Companies distribute dividends to their shareholders as a share of their profits. The amount received depends on the number of shares held by the investor. For tax purposes, dividend income is classified under the head "Income from Other Sources." ...Deduction for Royalty income

Royalty income is earned when someone pays to use your intellectual property, such as books or patents. The Income Tax Act provides specific deductions for such income to support innovation and creativity. Section 80QQB: Available to authors of books ...