Every person whose tax liability exceeds ₹10,000 in a financial year is liable to pay advance tax.

Advance tax is paid on a quarterly installment basis. This ensures that the government can collect taxes uniformly throughout the year.

On Quicko, you can:

Calculate advance tax

- Navigate to Planning > New vs Old Regime

- Enter the details of your

- Incomes

- Deductions

- Tax credits

- Losses

- On the right-hand side, you can see the Tax Calculation under both regimes

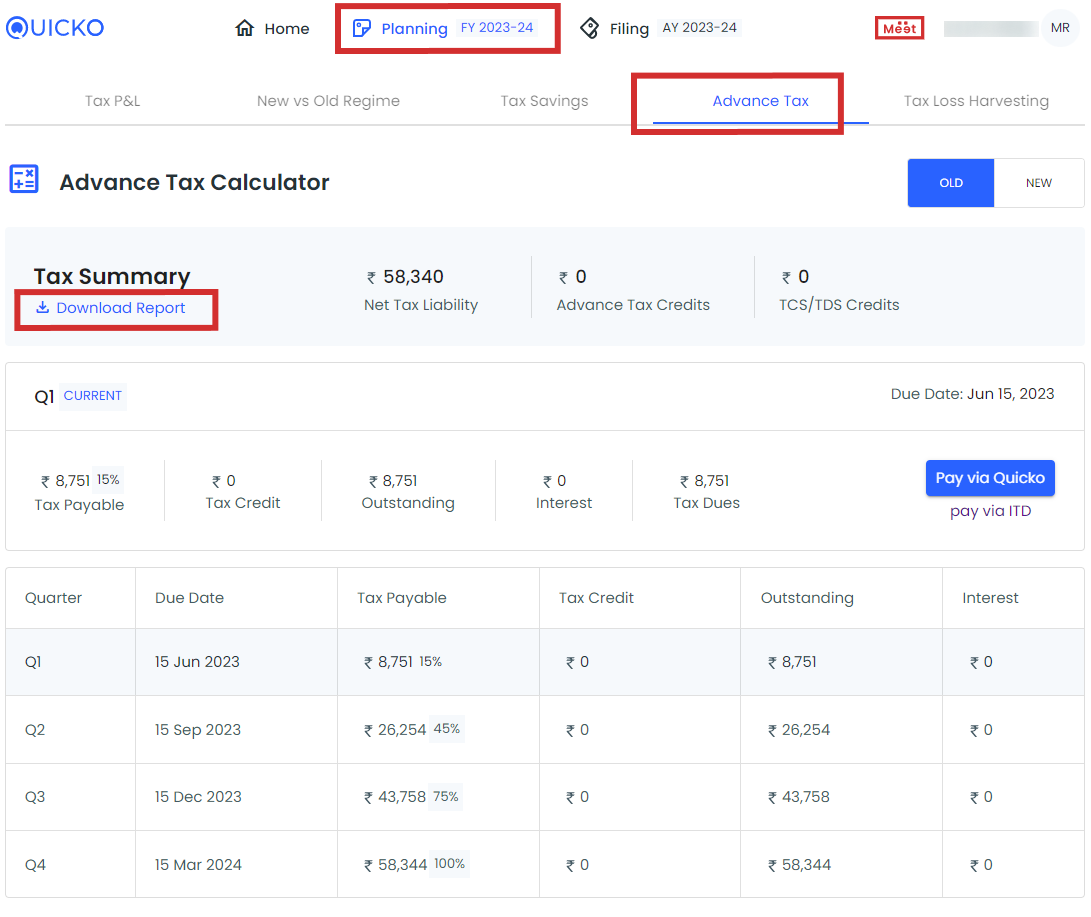

- Navigate to the Advance Tax to view the quarterly calculation & payment of Advance Tax, depending upon the regime chosen

Download the Advance Tax Computation Report

- Navigate to Planning > Advance tax

- Select the regime

- Click on Download Report

An Excel file with detailed computation of your tax liability will be downloaded

Pay advance tax

⚠️ Tax payments on Quicko have been disabled, as the Direct Tax TIN 2.0 services have been temporarily disabled by ITD, thus for the time being customers will have to initiate all Direct Tax payment form Income tax portal. So, here's how you can make the tax payment online from the Income Tax Portal.