How to add family member as an accountant on Quicko ?

If you need your family member’s help to file your ITR on Quicko, here’s how you can securely give them access to your profile:

Follow these steps:

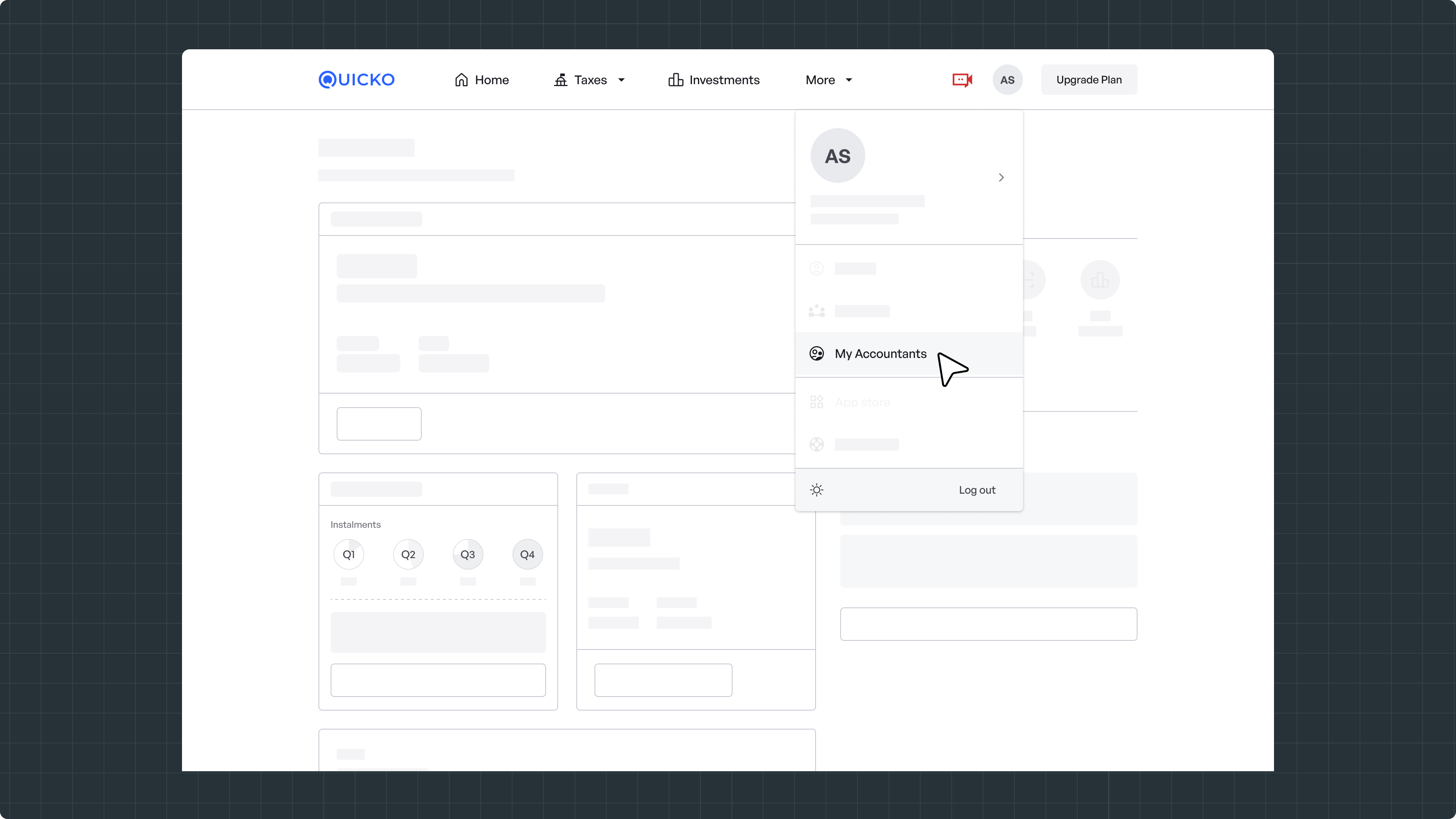

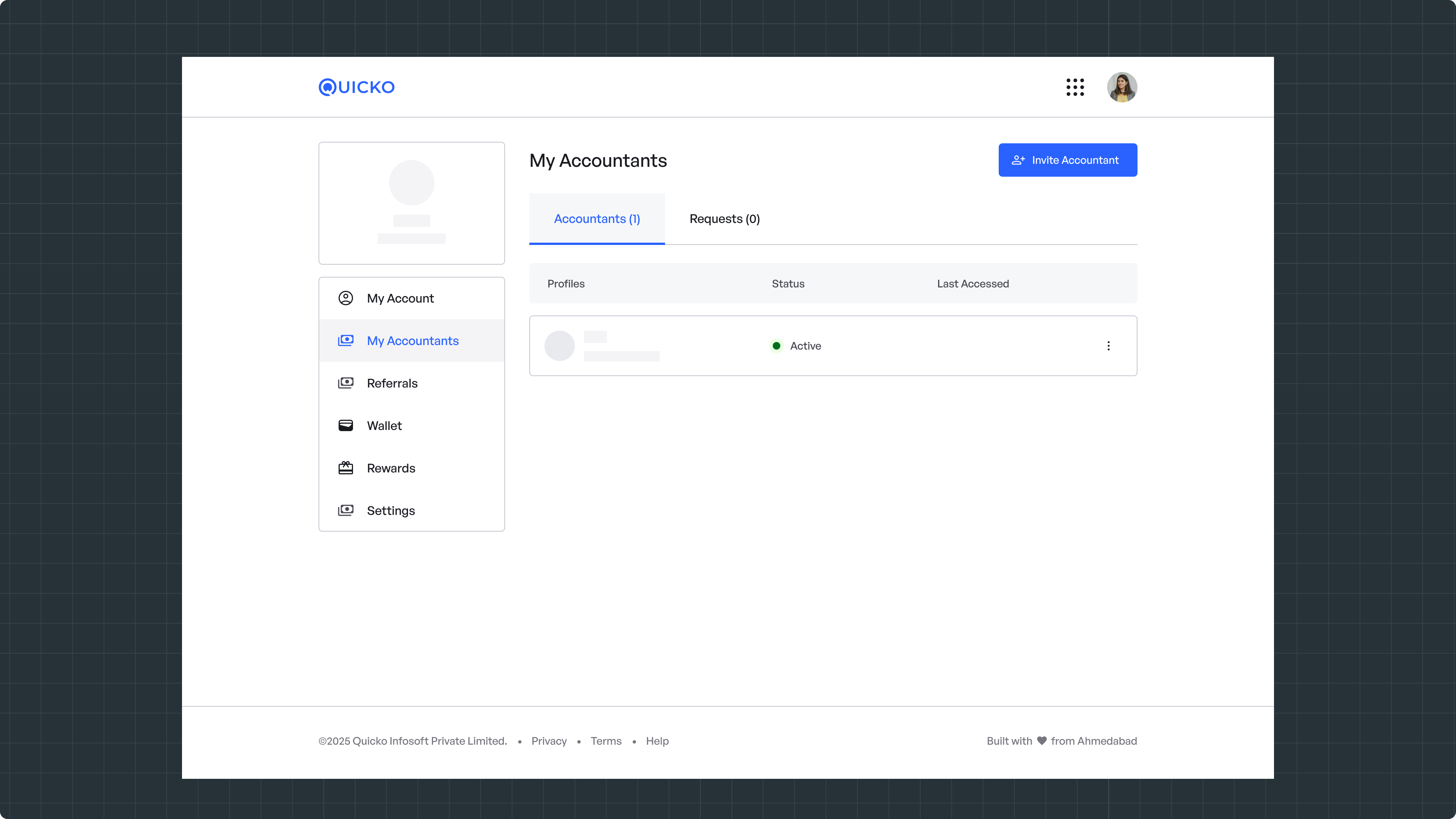

1. Click on your Profile Icon > My Accountants

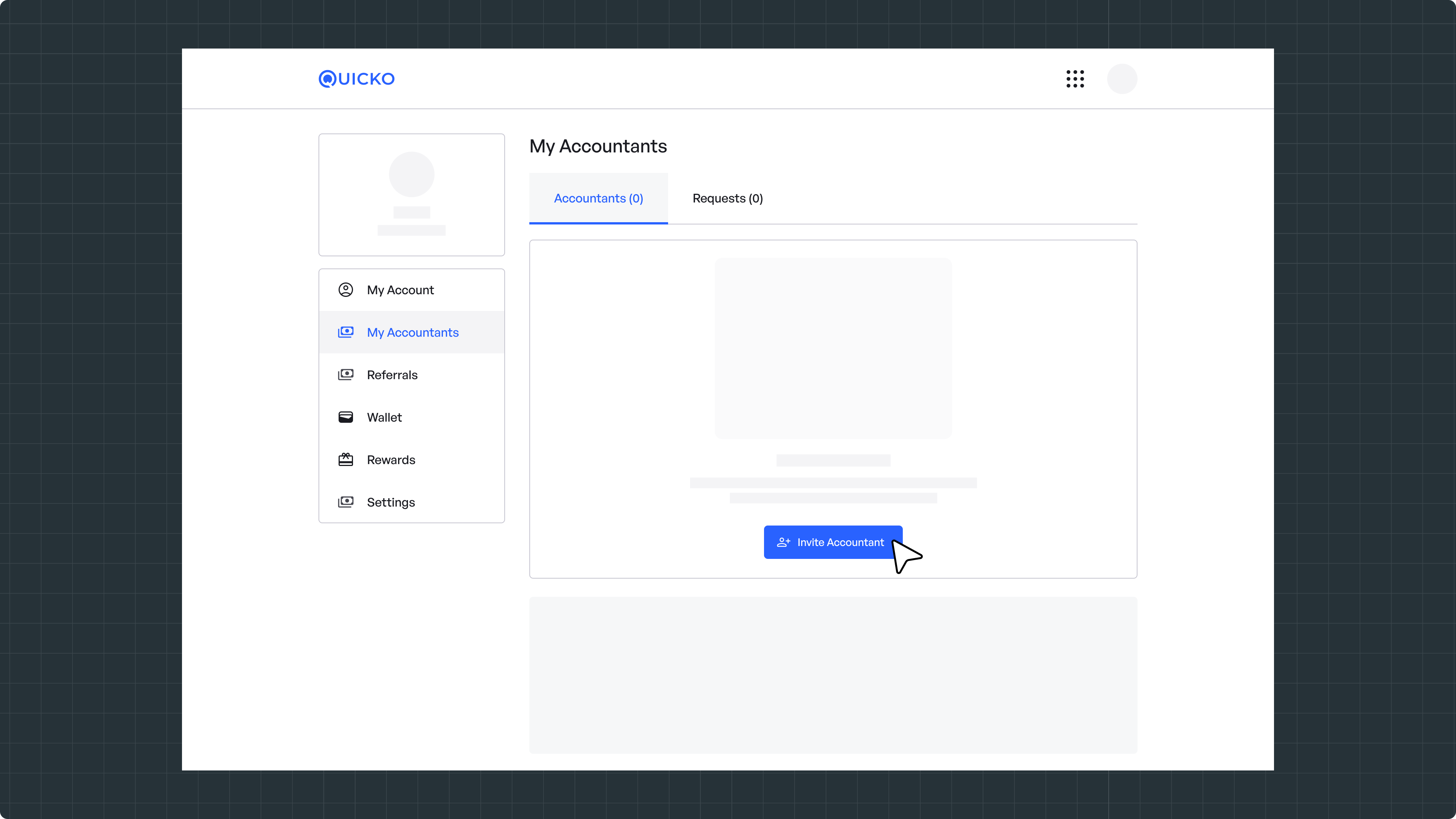

2. You'll see the option to Invite Accountant, click on it

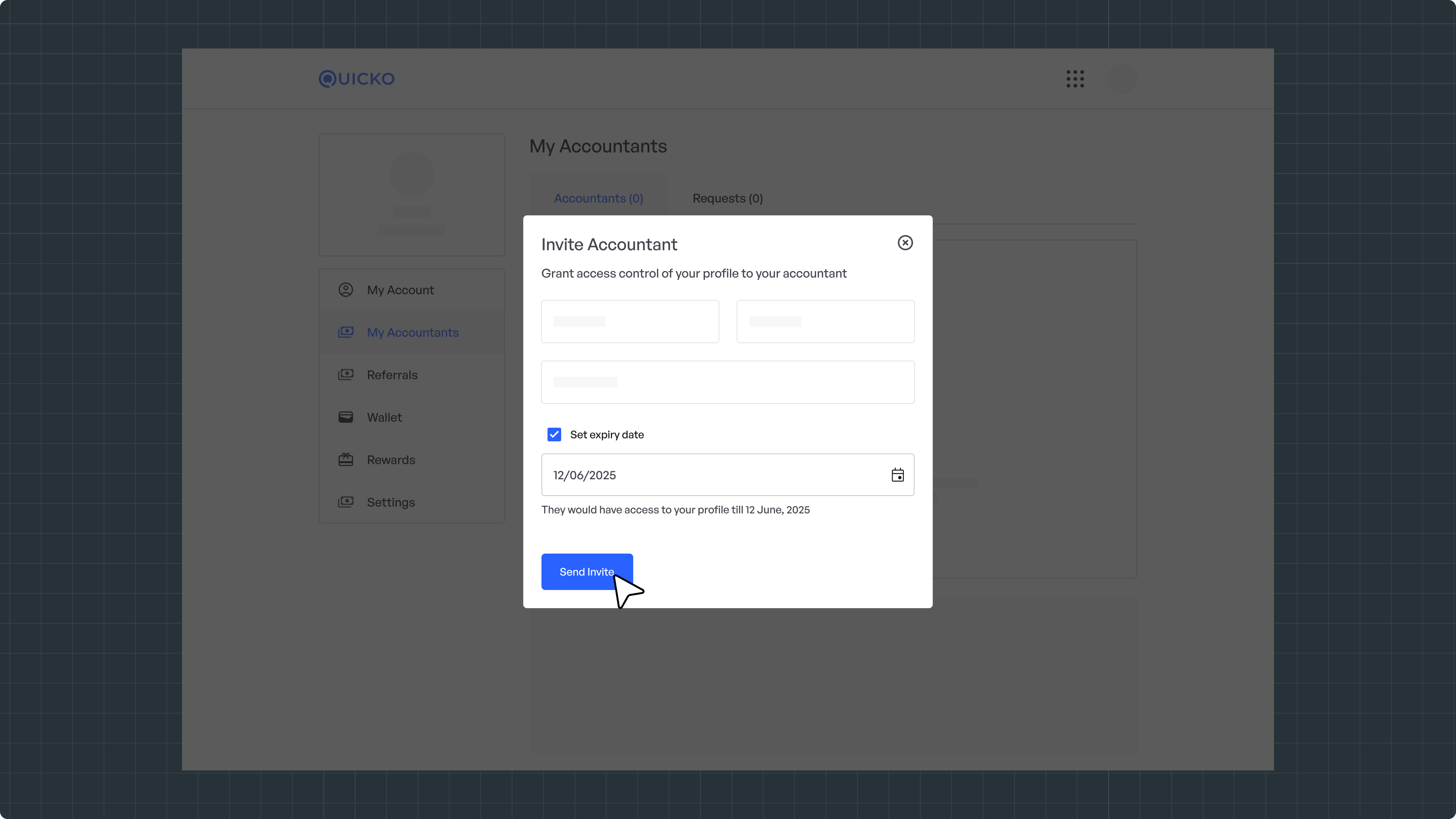

3. Add your Accountant’s Name and Email Address. You can also set an optional expiry date for access. Click Send Invite

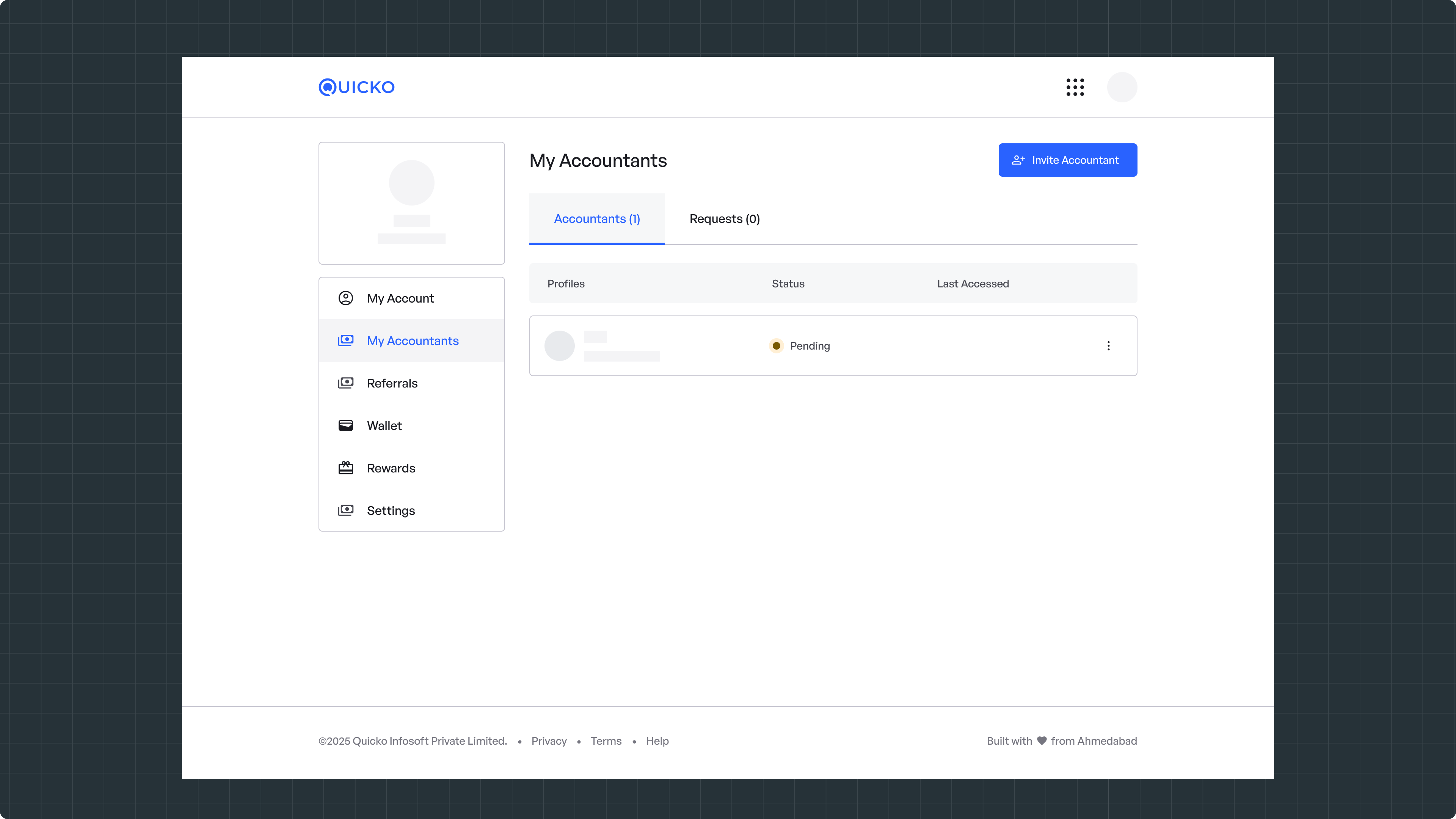

4. Once sent, you’ll see your Accountant’s status as Pending under the “My Accountants” tab

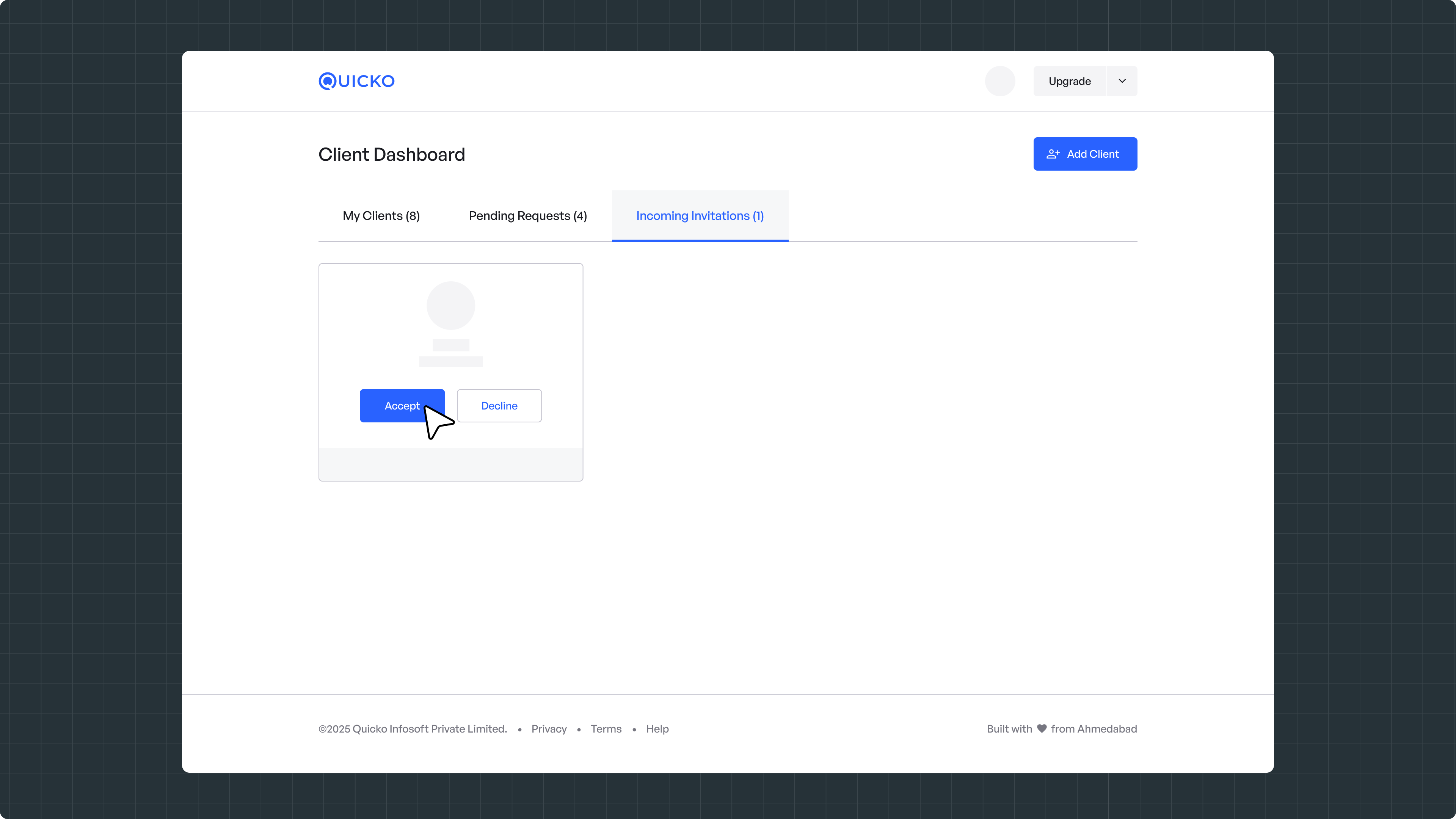

5. Now, your accountant needs to log in to accountant.quicko.com, go to Incoming Invitations, and click Accept

6. Once accepted, their status will show as Active

Your family member/accountant will now have access to manage your profile and file your ITR.

Need Help?

Raise a ticket and our team will get back to you.

Related Articles

How to invite family member as a client on Quicko?

To file taxes for a family member, they’ll first need to create their account on Quicko. Once that’s done, here’s how you can get started: 1. Go to accountant.quicko.com and log in to your Quicko account and click on Invite Client button. 2. Add your ...File Taxes for a Family Member

Once your family member’s profile is set up on Quicko, you can plan, calculate & pay their taxes, file their tax returns, and track refunds just like you would for your own account. You’ll also be able to access their tax documents and get expert ...Manage Family Pension Income

Family pension is the amount received by the spouse or dependent family members after the death of a government employee or other eligible individual. It is intended to provide financial support to the family after the passing of the primary earner. ...How to add Quicko as an E-return intermediary (ERI)?

An E-Return Intermediary (ERI) is a tax platform you’ve authorised to access your Income Tax Portal account and file your return on your behalf. If you’ve connected a platform but no longer wish to use its services, you can easily remove it in a few ...How to add foreign incomes?

If you have earned any kind of income from foreign countries, you have to report such incomes when filing your ITR in India. While adding these incomes, the process remains the same as adding regular incomes in each category. The only difference is ...