How to add Quicko as an E-return intermediary (ERI)?

An E-Return Intermediary (ERI) is a tax platform you’ve authorised to access your Income Tax Portal account and file your return on your behalf.

If you’ve connected a platform but no longer wish to use its services, you can easily remove it in a few simple steps on Income Tax Portal. Here’s the step-by-step guide

To set up an ERI in Quicko, simply follow these steps:

- Log in to Quicko

- Click on your Profile Icon > App Store

- 3. Go to Tax Department > Income Tax

4. Click Connect to link with the Income Tax Department

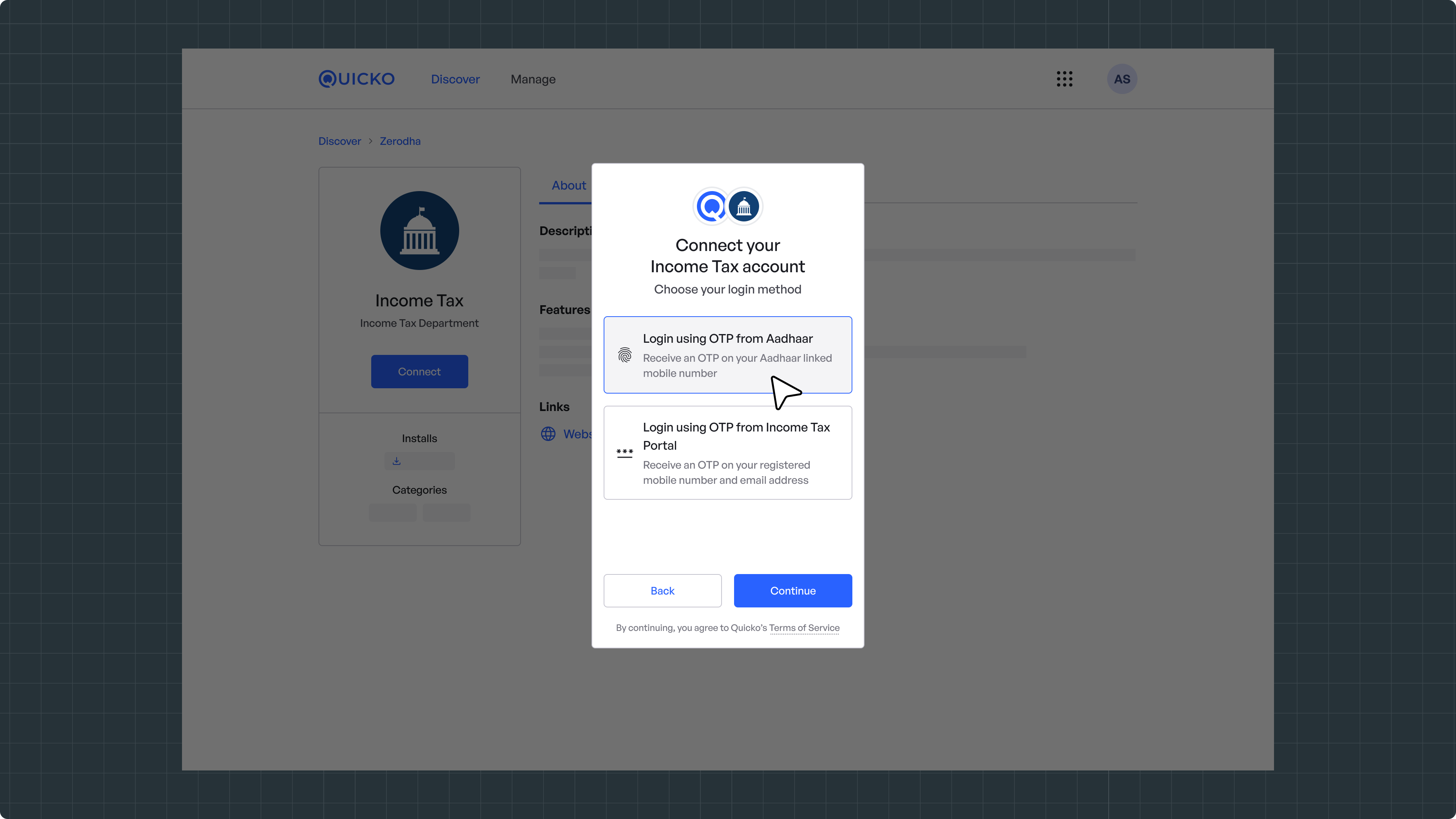

5. Select your preferred login method for the Income Tax Portal > Continue

Once connected, Quicko will be added as your E-Return Intermediary (ERI), and you'll be able to prefill, file, and e-verify your ITR.

Need Help?

Raise a ticket to get in touch with us.

Related Articles

How to add family member as an accountant on Quicko ?

If you need your family member’s help to file your ITR on Quicko, here’s how you can securely give them access to your profile: Follow these steps: 1. Click on your Profile Icon > My Accountants 2. You'll see the option to Invite Accountant, click on ...How to Add Form 10-IEA Details

Once you’ve filed Form 10-IEA, you’ll get an acknowledgement number. This number confirms your choice of tax regime and needs to be reported while filing your ITR on Quicko. Before adding it on Quicko, make sure to verify your Form 10-IEA details on ...Add Dividend Income

Companies distribute dividends to their shareholders as a share of their profits. The amount received depends on the number of shares held by the investor. For tax purposes, dividend income is classified under the head "Income from Other Sources." ...Add Salary Income

For most taxpayers in India, salary is the primary source of income. It comprises various components such as basic pay, allowances, bonuses, and more—all of which need to be accurately reported while filing your tax return. Understanding these ...Add Taxes Paid by You

Taxes paid by you include Advance Tax and Self-Assessment Tax. Advance Tax is paid throughout the year in four installments, based on an estimate of your total tax liability. Self-Assessment Tax, on the other hand, is paid after the financial year ...