Report Form-10IA details in Tax Return

If you or your dependent has a specified disability like autism, cerebral palsy, or multiple disabilities, you may be eligible for a flat deduction under Section 80U or 80DD. To claim it, you’ll need to file Form 10-IA as proof.

This form must be certified by a recognised medical authority and submitted on the Income Tax Portal before filing your ITR under the old tax regime.

Follow this step-by-step guide to file it correctly:

Report Form-10IA details in tax return

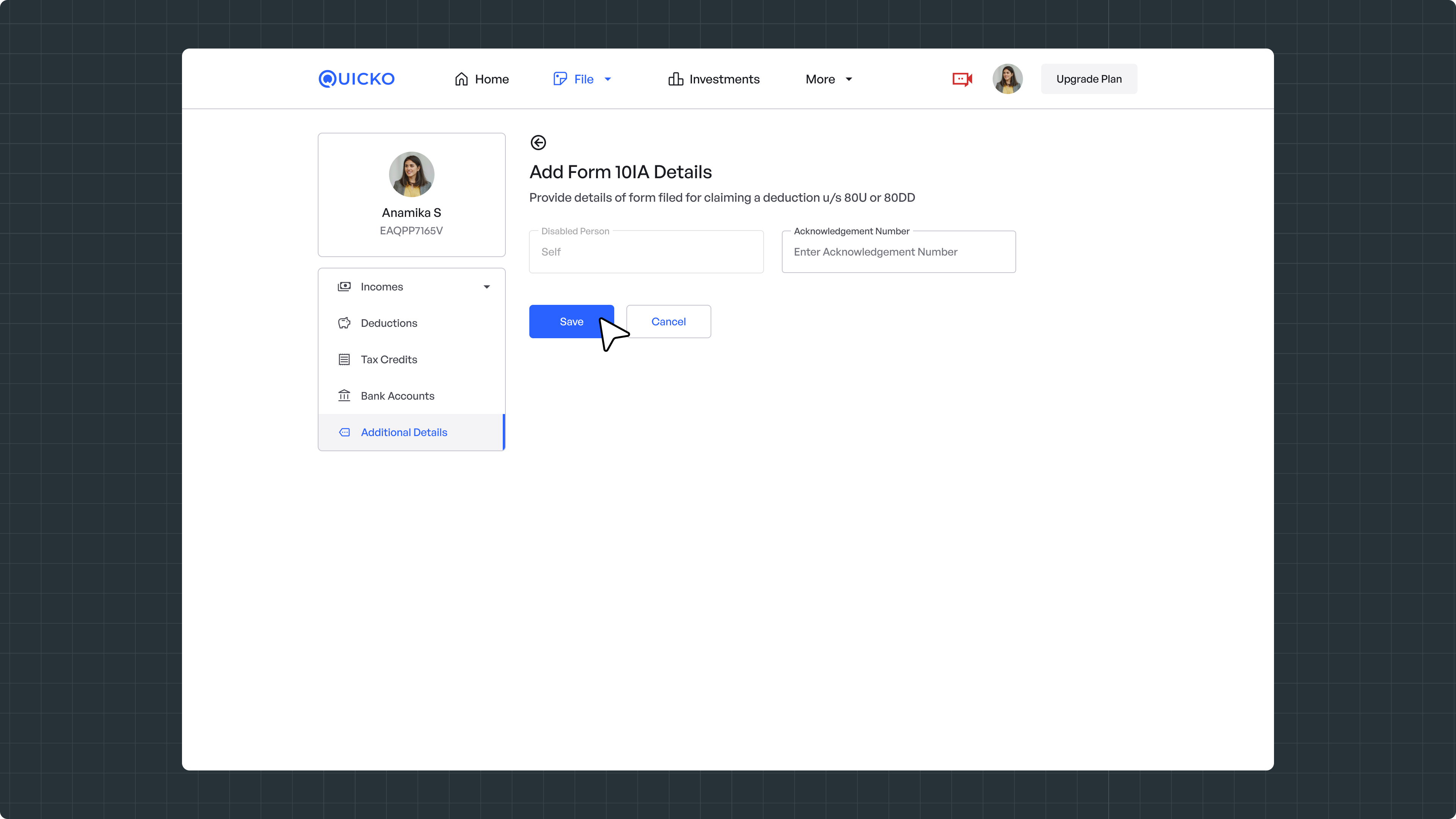

Once filed, you’ll receive an acknowledgement number. You’ll need to enter this number while filing your ITR on Quicko.

Here’s how:

1. Go to Additional Details

2. Scroll down to Disclosure and click on Form Disclosures

3. Under Deduction Related, select Form 10-IA

4. Select for who the Form 10-IA was filed for

5. Enter the Acknowledgement Number > Save

Your Form 10-IA is now successfully reported in your ITR.

Need Help?

Raise a ticket and our team will get back to you.

Related Articles

How to Add Form 10-IEA Details

Once you’ve filed Form 10-IEA, you’ll get an acknowledgement number. This number confirms your choice of tax regime and needs to be reported while filing your ITR on Quicko. Before adding it on Quicko, make sure to verify your Form 10-IEA details on ...Understanding Tax Computation Report

A tax computation report is a summary of your tax return. It is divided into four main sections: Personal details - Name, PAN, email, etc. Income tax return details - Return type, regime, filing date, acknowledgment number. Tax computation summary - ...Add Tax Credits using Form 26AS

Form 26AS is your annual tax statement that shows all the taxes deposited against your PAN. This includes TDS (Tax Deducted at Source) on your salary or interest income, and TCS (Tax Collected at Source) on high-value transactions. You can download ...How to file Form 67 on Income Tax Portal?

If you've earned income outside India and paid tax on it in the foreign country, you may be eligible to claim Foreign Tax Credit (FTC) in India. This helps you avoid double taxation on the same income. To claim this credit, the Income Tax Department ...Add Salary Income without Form 16

Web Mobile Web Steps to add salary income using pay slips: Navigate to File > Incomes > Salary Choose the Add Manually option and proceed Add your employer’s name, category, and address Enter your salary breakdown, including gross salary, allowances, ...